Dog-friendly vacations: 34 tail-wagging travels for 2025

Coordinating Your pet deserves luxury on vacation, and so do you. Selecting the right destination can provide you and your pet with the carefree escape you’re hoping for — and maybe even introduce you to a location for a second home that's great for you and your pup. Browse these top pet-friendly vacation spots — listed in no particular order — to get ideas for your next trip. Ready, set, go fetch your next dog-friendly vacation destination! 1. Block Island, Rhode Island When it comes to dog-friendly vacations, Block Island is one destination you won’t want to miss. From scenic walks to water taxis, there's so much for you and your pup to enjoy together. Brenton Point State Park offers beautiful views of the bay, with kite fliers taking advantage of the gusty ocean winds. Have a picnic at Grab a bite to eat at 2 The City of Brotherly Love extends its hospitality to four-legged friends. Visit For a break from the concrete jungle, head to the 3 This Northeast pet friendly vacation spot has beaches, brewskies and bogs to entertain you and your dog. Surfside, Brant Point and Cisco Beaches all provide sandy ocean fun. Take a ride on the When it’s time to rehydrate and replenish your calories, head to Easy Street Cantina or the Sandbar at Jetties Beach for fresh food and refreshing drinks. In terms of dog vacations, this one is hard to top. 4. Jim Thorpe, Pennsylvania What may at first seem like a sleepy town in the Poconos is a must-see place to go with your dog. Fido is welcome on the vintage

5. Long Island, New York The largest island in the country offers pet-friendly beaches, hiking trails and more. Take your dog walks up a notch by strolling around

Long Island has plenty of dog-friendly breweries, and there’s even a tour that takes you to all of the best neighborhood taprooms. 6. Lake Placid, New York There’s so much to experience in Lake Placid. Enjoy a convenient stay at the pet-friendly Town House Lodge, just a stone's throw away from the lake and a short walk from Main Street. Rent a boat from

The 7. Stowe, Vermont Stowe has no shortage of pet-friendly vacation ideas. The 8. Bar Harbor, Maine If you and your furry friend share a love for the ocean, the seaside town of Bar Harbor has everything you need. This quiet town of 5,000 provides nature cruises for leashed pets, so you both can try spotting a variety of sea creatures, like porpoises and seals.

Take a picturesque walk around dog-friendly 9. Chicago, Illinois Bring your pet to this lakeside city for fun on and off the water. Multiple Montrose Dog Beach allows your pet to dip their paws in the lake and even provides free waste bags and a dog wash area. The pet-friendly 10. Madison, Wisconsin Sitting on an isthmus between two lakes, Madison has a whole lot of green space perfect for traveling dogs, including

For two-legged visitors,

The BarleyPop Tap and Shop provides another dog-friendly taproom with an extensive craft beer selection. If spirits are more your thing, the 11. Milwaukee, Wisconsin Stroll Milwaukee’s winding

Treat your good dog to a spa day at 12. Grand Haven, Michigan This cozy western Michigan town offers plenty of fun for you and your pup while avoiding the overwhelming crowds of some better-known dog-friendly getaways. Take your time as you stroll down the Rent your own pontoon for a relaxing cruise or a water skiing excursion. Then step back into a time capsule at 13. Cleveland, Ohio This Lake Erie city blends freshwater fun with urban attractions. The downtown dog park offers 3,500 square feet of off-leash play space. The Then head to the 14. Indianapolis, Indiana This dog-friendly getaway blends city entertainment with natural attractions. The Enjoy the Downtown Canal Walk’s three-mile loop, or rent a pedal boat for a unique view of the city. Treat your pup to a movie at the 15. St. Augustine, Florida St. Augustine, the oldest continuously inhabited city in the U.S., is brimming with history for you and your pet to experience together. Ponce de Leon’s Fountain of Youth Archaeological Park includes a planetarium, Timucua Native American village and an observation deck. Wild peacocks roam the park, so be sure to keep your dog leashed. In town, you can take your dog on a wine-tasting tour in a horse-drawn carriage or ride on 16. Key West, Florida

Your leashed dog can stay by your side as you tour the local aquarium and witness shark feeding and alligator exhibits. You won’t want to miss your chance to dine on fresh seafood like fish tacos at 17. Asheville, North Carolina If the Southeast is more your style, grab the leash and head to Asheville, North Carolina. Take a stroll through Asheville has trolley tours for dogs up to 25 pounds, or you can scratch nature’s itch with a walk through 18. Charleston, South Carolina Fans of the macabre won’t want to miss the city’s 19. Hilton Head, South Carolina You can stick to living on island time at pet-friendly The 20. Shenandoah Valley, Virginia Virginia may be for lovers, but it’s also great for your fur baby. Shenandoah Valley has dog-friendly wineries, nature trails and other activities. The 21. Birmingham, Alabama Get a taste of Southern comfort food at Crazy Cajuns’ Boiling Pot, the punk rock-friendly Black Market Bar and Grill or Back Forty Beer Company. 22. Austin, Texas Austin is one of the best pet-friendly vacations in the United States! Prepare for sensory overload at the When you need a little extra energy to make it through the day, or maybe just to burn some of your pet’s energy, head to the 23. Sedona, Arizona 24. Albuquerque, New Mexico This Southwest city is well-known for its delicious food and lively festivals, but its reputation as a pet-friendly destination is also noteworthy. Your leashed dog can join you on an outdoor adventure along the La Luz Trail, much of If you need to give your paws a break, hitch a ride on the open-air 25. San Francisco, California San Francisco makes our list of best pet-friendly vacation spots thanks to its gorgeous scenery and dog-friendly accessibility. Your dog can splash in salt water at Golden Gate Park’s off-leash section is a viable alternative for dogs wanting to keep sand out of their fur. For an added activity, try the modern treasure hunt known as geocaching, which is great for dogs and children alike.

26. South Lake Tahoe, California Bring your dog with you as you try your hand at sport fishing, kayaking or paddleboarding. Lake Tahoe’s dog-friendly beaches also provide the option for a restful day soaking up the sun. Stop at the 27. Huntington Beach, California Huntington Beach — aka Surf City, with its 10 miles of coastline — is an evergreen pet-friendly vacation destination, thanks to its sunny After a day of frolicking on the beach, try some fresh seafood at 28. San Diego, California Make your dog’s ocean dreams a reality by taking a pet-friendly vacation to

For a more sure-footed activity, spend the afternoon at the 29. Napa, California Stock up on necessities or treats for you and your dog at the 30. Colorado Springs, Colorado Get away from big-city vibes and get back into nature in Colorado Springs. The impressively named For the less adventurous, Colorado Springs has plenty of places to go with a dog. 31. Kanab, Utah You have to see Kanab to believe it. Known colloquially as “Little Hollywood,” dozens of movies and television series are filmed in and around the area’s national parks due to the striking scenery. Your dog can join you as you walk remote trails, or you can both jump in a 4x4 for a guided desert safari.

Be sure to stop by the 32. Boise, Idaho If you and your hound are tired of being confined indoors, Boise is a perfect pet-friendly escape. Tree-lined paths link the Winstead Park offers designated off-leash hours throughout its 11 acres of green space. The Spacebar Arcade lets you drink and game with your dog by your side. And your pup is welcome at the 33. Seattle, Washington Beat the heat with a pet-friendly vacation to the Pacific Northwest. Visit the city’s largest downtown green space at Along the shores of Lake Washington, you’ll find the 230-acre 34. Bend, Oregon The city of

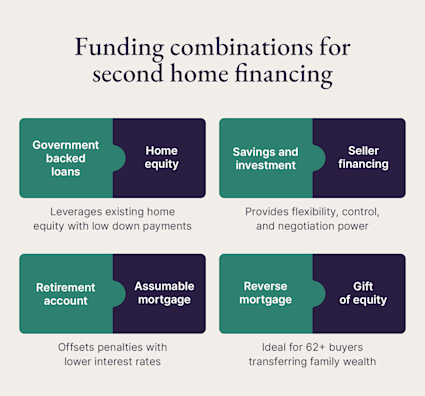

The Riverbend Beach Dog Park is a fenced oasis for your furry friend to socialize in and out of the water. Drink in Bend’s craft beer scene by walking the Taking a vacation with man's best friend requires some extra planning, but with some careful preparation — it'll give both you and your pup something to wag about. Before you hit the road, make sure your pet is primed for the journey. Pack essentials like food, water, bowls, a leash, and any necessary medications to set your pack up for success. Ensure your pet's identification and vaccinations are current, and consider a microchip for extra safety. If traveling by car, secure your pet with a harness or carrier, and plan for frequent breaks for potty stops and exercise. After all, a tired pup is a happy pup! When selecting a dog-gone great destination, consider the climate and specific activities you and your pet will enjoy. Research pet-friendly parks, Sites like BringFido, Petswelcome, and GoPetFriendly specialize in pet-friendly accommodations. They have filters to narrow your search based on pet size, breed, and any extra fees. For example, on BringFido, you can filter for hotels with no size restrictions, which is perfect if you have, say, a Great Dane. Sites like Now that you've planned your destination and travel, it's time to nail down an itinerary that will Here are some of the best types of activities to share with your dog on vacation: The great outdoors is almost always a safe bet for dog-friendly vacations. Hike scenic Who says pups can't be cultured? Many experiences, such as museums, zoos or historical tours, are pet-friendly. For instance, in Charleston, South Carolina, you can take a pet-friendly After a day of exploring, treat yourself and your furry friend to some delicious eats, a local beverage, or some Remember to always confirm pet policies beforehand to ensure an enjoyable experience for you and your pet. Tips for a pet-friendly vacation The key to a successful pet friendly vacation is preparation. Keep these tips in mind before hitting the road or taking to the air. 1. Consider the mode of transportation How you’ll get to your destination depends on how far away from home you’re going, of course, but you’ll also want to consider your dog’s comfort. Some dogs are perfectly fine flying on an airplane, but it can be traumatic for others. Some dogs love a road trip, while others don’t like being stuck in a car for a long time. Consider your dog’s personality before plotting your course. 2. Test your pet’s travel tolerance Before you go on a vacation with pets, see how they respond to being cooped up or in a car for long periods. You may discover they get motion sickness or need more frequent breaks than you were prepared for. 3. Double-check dog-friendly accommodations Before you leave, it’s smart to verify that you can bring your furry friend along to your hotel or vacation rental. Businesses can change their policies at any time and you don’t want to be left without a place to stay. The best dog-friendly hotels go out of their way to welcome four-legged guests, with special amenities like treats and dog beds. Regardless of where you stay, it’s important to note even when dogs are allowed, many hotels won’t allow you to leave your pet unattended in a hotel room while you’re out and about. 4. Make a dog-friendly vacation itinerary Think through the places you want to visit on your vacation. For example, dogs are allowed in most national parks, but you’ll need to keep them on a leash and on the trail at all times. In town, look for pet-friendly restaurants with outdoor dining options. 5. Pad your travel schedule Even a well-trained dog can act out of character in new or unfamiliar environments. Allow for extra time for your four-legged friend to get acclimated so you don’t miss out on sought-after activities or reservations. 6. Update your pet’s identification and vaccinations Make sure their collar or chip has your current contact information. This way if you get separated while on vacation, they can be identified and reunited with you. On top of that, doublecheck that all of your pet’s vaccinations are up to date. Many businesses, including 7. Bring extra supplies Pack more waste bags, medications and other necessities than you think you’ll need, just in case. Don’t forget to pack food, a water bowl and a few items to help your pet feel comfortable, like a portable dog bed and a few of their favorite toys and treats. Buy your own dog-friendly vacation home Like most humans, most pets enjoy a sense of familiarity and routine. Instead of staying in a new hotel in a new city every time you travel, consider setting down roots in your (and Fido’s!) favorite dog-friendly vacation destination. The best dog vacation is one your pup will enjoy every time. As a second home owner, you can enjoy all the comforts of home while venturing out together in search of local dog-friendly parks, dog-friendly hiking trails and maybe even a dog-friendly beach. It should come as no surprise that man’s best friend can also make a great companion on your travels, but pet-friendly vacations require a special type of planning to make them enjoyable. Use the destinations on Imagine having a second home in one of these pet-friendly destinations. Browse

Read