12 Luxury real estate market trends for 2025

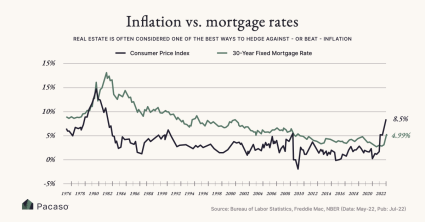

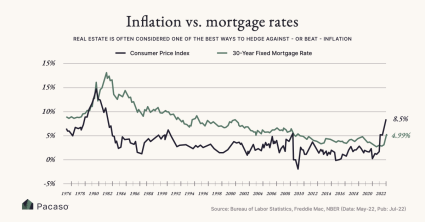

Say you've been planning the ultimate luxury vacation for a couple of years. You've got your list of dream destinations, top-notch resorts, and must-try experiences all lined up. But just as you're about to book, you discover some places have become overcrowded, while hidden gems have emerged elsewhere. Suddenly, your itinerary needs a revamp. The luxury real estate market isn't much different. Economic shifts, evolving consumer tastes, and technological innovations continually reshape the landscape. In this guide, we’ll walk you through the top luxury real estate trends of 2025 so you can create a strategy that leads to 1. Smaller homes are becoming more luxurious Smaller homes continue to gain popularity among luxury buyers in 2025, and it's not just about saving money — it's a lifestyle choice. Recent data from the Affluent buyers are prioritizing convenience and financial flexibility, seeking homes that require less maintenance without sacrificing those high-end finishes we all love. Many buyers are choosing smaller homes because they're easier to purchase with cash, avoiding mortgage debt and those pesky rising interest rates. Why smaller luxury homes work: 2. The luxury market is stabilizing as inventory rises and price growth cools After years of soaring prices and fierce competition, the luxury housing market is shifting toward a more balanced state in 2025. The extreme ups and downs we've seen in previous years are leveling off as more high-end properties become available. This increase in supply is giving buyers more options and cooling down the frenzy that once drove those intense bidding wars. In some areas, luxury home prices are even seeing slight declines — a welcome change for buyers. While demand for luxury properties isn't disappearing, the days of skyrocketing prices and bare-bones inventory seem to be behind us, pointing to more stable luxury real estate trends in the coming years. 3. The luxury real estate market is becoming more globalized Market trends in “Texas is seeing steady growth, especially in cities that offer business opportunities without the tax burdens of other states. At the same time, international luxury markets are evolving. A study by 4. Luxury price growth is slowing while select markets experience corrections Luxury home prices in the U.S. continue to rise, but the pace of growth is slowing. According to Redfin, the Some markets are still seeing impressive gains, such as: However, signs of correction are emerging in select cities, like: This suggests a potential shift in the New listings in the luxury market have surged in several key areas, giving buyers more choices and taking the pressure off prices. Providence, RI (31.5%), Miami (28.1%) and Tampa, FL (27.6%) saw the biggest jumps in new luxury home listings. Meanwhile, the pace of sales varies dramatically — on average, luxury homes in Seattle sold in just six days, while Miami's high-end properties lingered for 114 days. These luxury real estate market trends highlight how the high-end housing sector is evolving, with some cities still seeing rapid growth while others are cooling down or making slight adjustments. 5. Cash is king, but financing is gaining traction in the luxury market While cash has traditionally dominated luxury real estate transactions, financing is making a comeback as interest rates begin to descend. Though interest rates remain higher than pre-pandemic levels, their gradual decline opens financing options for luxury buyers. Many wealthy individuals still prefer cash purchases to avoid borrowing costs, but others are dipping their toes back into the mortgage market as rates become more attractive. Beyond traditional mortgages, savvy buyers are getting creative with margin loans, stock portfolio loans and private banking credit lines to fund their purchases. Cash remains a powerful advantage in competitive markets where bidding wars still happen. However, as borrowing costs continue to fall, experts predict more luxury buyers will incorporate financing into their strategies. This shift reflects a broader normalization in the 6. Luxury buyers are adapting to evolving interest rates With This hesitation creates a more balanced market, forcing sellers to adjust their expectations. As overpriced homes sit longer, buyers are holding out for better deals, potentially leading to win-win negotiations for both parties. Despite the challenging economic environment, cash-rich buyers remain active in the Dahlia Fox, a real estate agent with The luxury real estate market in 2025 is likely to see more price adjustments as everyone adapts to the new financial reality. 7. Luxury second-home market and co-ownership is booming Even with economic challenges, the demand for luxury

Real estate expert and Platforms like Pacaso, where families can purchase fractional ownership of a luxury home with maintenance handled, are gaining popularity. This trend in the luxury home market makes owning that 8. Investors are expanding their portfolios with high-end real estate Despite economic shifts, luxury real estate remains a stable and attractive asset. Investors are particularly eyeing Thomas Franklin, Founder and CEO at This shift toward managed asset pools lets investors spread their capital across multiple luxury properties, enjoying both flexibility and access to global markets while minimizing risk — a trend that's reshaping luxury real estate market trends in 2025. 9. Smart homes are becoming essential rather than a luxury feature According to Rachel Stringer, "Technology is built into every part of high-end real estate now. Homes that aren't equipped with automation, security and seamless integration of smart features feel outdated before they even hit the market." With AI, IoT and big data working together, these smart systems are completely transforming how luxury homes operate, delivering next-level comfort and efficiency that today's discerning buyers demand. These luxury home trends are rapidly becoming the new standard rather than exceptional features. 10. Luxury buyers are prioritizing sustainability Sustainability is becoming a top priority for luxury buyers in 2025, with a growing emphasis on energy efficiency, eco-friendly materials and green spaces. As climate awareness rises and government regulations tighten, we're seeing a notable shift toward sustainable Rachel Stringer puts it perfectly: "The conversation about sustainability has also shifted. It's not about marketing a home as eco-friendly for show — it's about efficiency. Solar panels, energy storage, water recycling and passive design are becoming standard because they lower long-term costs and increase self-sufficiency." Investing in green properties with 11. Luxury home buyers are prioritizing resiliency features Luxury home buyers are increasingly looking for properties that can weather natural disasters — literally. In regions prone to hurricanes, wildfires and flooding — like California, New Orleans and Florida — buyers want more than just beautiful homes. They want properties with features that ensure their investments remain safe and functional no matter what Mother Nature throws their way. These features include: Nathan Mathews, CEO of 12. Gen-X and Millennials will influence the market Millennials and Gen-Xers are reshaping the luxury real estate market. Affluent millennials gravitate toward homes featuring cutting-edge technology, sustainability and energy efficiency, viewing real estate as a lifestyle statement and a financial investment. Their preference for urban properties or resort homes with income potential drives demand for smart, sustainable luxury properties across the market. Gen X buyers, now in their prime earning years, are focusing on long-term asset diversification. With wealth inherited from baby boomers, they're seeking homes with premium amenities, enduring value and stability for future generations. As Rachel Stringer notes, "Millennials and Gen X prioritize functionality, privacy and convenience. They want spaces designed for how they actually live — integrated wellness features, easy-to-maintain outdoor areas and turnkey properties." These generations are significantly influencing luxury real estate trends with their distinct preferences and priorities. Luxury real estate made easy with Pacaso The luxury real estate market is always evolving, and 2025 promises to bring new opportunities and challenges for prospective buyers. Whether you're looking for a primary residence or a To stay ahead of the latest luxury real estate market trends and discover exclusive high-end listings, Pacaso can help you cross the finish line on your vacation home ownership journey (or even help you figure out how to

Read