Luxury homes with low financing

See allHow to use the second home mortgage calculator

This easy-to-use calculator breaks the number-crunching down into a few steps. Simply plug in details about your total monthly income and debt obligations, then continue on to determine how much you can afford. The calculator is only as accurate as the numbers you put in, so try to be as exact as possible with your current financial status. Let’s walk through the steps:Step 1

On the first screen, you’ll input some of your financial data to calculate your monthly debt-to-income ratio. As you do, here are the figures you’ll be asked to enter:- Employment income: This is the amount of money you receive from your primary job per month before taxes are withdrawn.

- Supplemental income: Add any money outside of your primary income that you can reliably depend on from month to month. Rental income is a common form of supplemental money, as are investment earnings, child support and alimony.

- Current total monthly mortgage payment: This is how much you spend every month on the mortgage amount for your primary residence. For an accurate representation of your monthly costs, you’ll want to include property taxes and homeowners insurance — not just the principal and interest portions of your mortgage payment.

- Total monthly housing expenses: Enter how much you spend each month on other household-related costs, like utilities and maintenance.

- Monthly debt payments: Total up other monthly payments that go toward debt obligations. This includes things like car payments, credit cards, home equity loans or student loans.

Step 2

On this screen, you’ll see your current debt-to-income ratio (DTI). A commonly used term in real estate lending, DTI is calculated by dividing your monthly debt obligations by your gross monthly income. The lower your DTI, the more favorable you will be seen by mortgage lenders. This screen also shows you your estimated cash on hand. This is the amount of money you have left over each month after deducting recurring expenses.Step 3

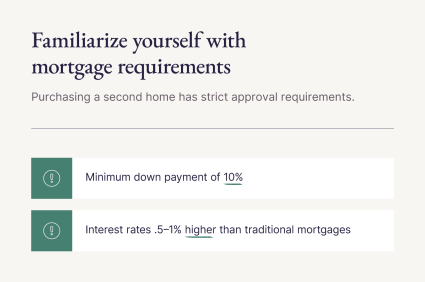

This step helps you figure out how much you can afford to spend on a second home. You’ll be asked to input the following information:- Second home down payment: This is the amount of money you’re willing to pay upfront for the home. A larger down payment (20% or more) usually results in a lower interest rate.

- Second home mortgage rate: This is the rate of interest charged by your lender. You’ll want to do some quick research on current interest rates. Note that interest rates on second homes tend to be a bit higher than on primary residences.

- Mortgage loan length: This is the number of years it will take to pay off your loan. The longer the loan, the higher the interest rate.

Step 4

Here, you’ll see your results. Based on all your inputs, you’ll see how much you can afford to spend on a second home. If you’d like to explore Pacaso second homes, you can simply click “View listings” and check out the homes that are available within your housing budget. Now that you’ve done the math, let’s explore how you can make second home ownership work for you.5 factors to consider when buying a second home

Since lenders make money off of interest rates, they are incentivized to offer the highest amount possible to a home buyer. Just because you may qualify for a large loan doesn’t mean it’s in your best interest to accept it in full. Remember that in addition to monthly mortgage payments, second home owners are still responsible for:- Annual property taxes

- Homeowners insurance

- Utility payments

- Possible homeowners association fees

- Regular maintenance

- Mortgage insurance (if your down payment is less than 20%)

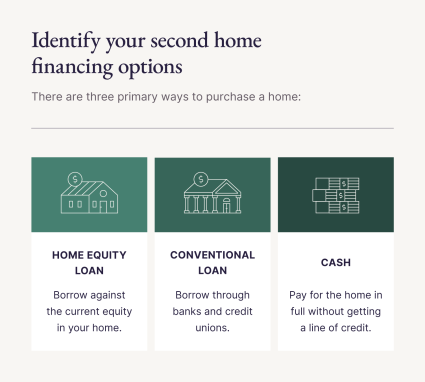

1. Know your financing options

- Home equity loan: Also known as a second mortgage, home equity loans allow you to borrow against the current equity you have in your home. They provide a lump sum of cash or line of credit for you to make a purchase. If your property loses value, you may owe more on the loan than the property is worth.

- Conventional loan: You can receive these loans through traditional lenders like banks and credit unions. Just like your primary mortgage, you’ll make monthly payments of principal and interest until your loan is paid off.

- Cash: Paying for a home in full will reduce the overall cost of owning a second home because you won’t be paying interest on a loan.

2. Revisit your current financial status

3. Understand second home mortgage requirements

4. Know your options for second home ownership

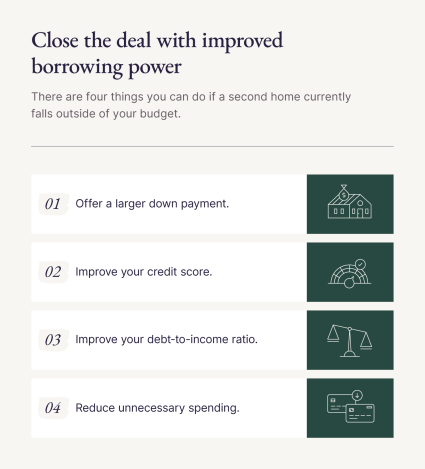

5. Learn how to increase your borrowing power

- Offer a larger down payment. Your current income may be fixed for the time being, but if you have enough savings, you can pay a greater percentage of the house purchase price in cash. This will reduce your monthly payment and make your loan less risky to lenders, which may give you access to a lower interest rate.

- Improve your credit score. Higher credit scores mean lower interest rates, keeping more money in your pocket every month. Paying debts, including credit cards, on time has the biggest impact on your score, but utilizing 30% or less of your credit line also plays a big role. Or you can try consolidating your debts so that you’re only dealing with a single payment that might have a lower interest rate.

- Improve your DTI. If your current debt-to-income ratio exceeds 43%, focus on paying off some of your debts or finding ways to increase your income, or both.

- Reduce unnecessary spending. Small, individual expenses like eating out add up fast. What small (or not-so-small) luxuries are you willing to forgo in order to secure your second home? If you’re struggling to save for a down payment, take a look at your everyday spending habits and see where you can cut back or find more affordable alternatives.

Track your progress over time

Still wondering, “Can I afford a second home?” Even if the answer isn’t a yes right now, you have the power to change it. Bookmark this calculator and come back to recalculate based on your progress. When you’re ready to make a second home purchase, Pacaso will be ready to help you through the process and find you the house of your dreams.Frequently asked questions about financing a second home

01: Can I use a mortgage to pay for a second home?

Yes, there are fixed-rate and adjustable-rate mortgages available for a second home purchase. Whether you can use a mortgage to buy a vacation home depends on your ability to qualify. If you have a mortgage on your first home, you’ll need to show the lender that you can afford to take on a second monthly payment. The application process will include checking your credit profile and credit score and calculating your debt-to-income ratio.

02: Can I deduct mortgage interest on a second home?

Generally, second home owners can deduct mortgage interest on a loan of up to $750,000, as long as you use your second home for personal use — meaning, you don’t generate any rental income. The rules can be complicated, so check with your tax professional.

03: Can FHA or VA loans be used for second home purchases?

No. Government-backed loans like FHA loans and VA loans can’t be used for second home purchases. They’re designed to help make it more affordable to buy a primary residence.