What is a home equity loan?

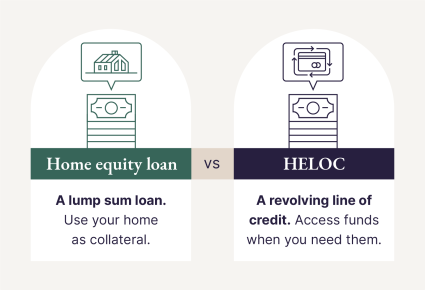

A home equity loan allows homeowners to borrow money by using the equity in their home as collateral. Equity is the difference between the market value of your home and the outstanding balance on any existing mortgage.

- Loan amount: Lenders may allow you to borrow a percentage of your home's appraised value minus the outstanding mortgage balance.

- Interest rate: Home equity loans often have fixed interest rates, meaning the interest rate remains constant over the life of the loan.

- Repayment terms: Home equity loans are typically structured as fixed monthly payments over a set period.

- Collateral: The home serves as collateral for the loan.

Can I use my house equity to buy another house?

Yes, it is possible to use the equity in your current house to buy another house. Although specific scenarios warrant using a home equity loan, you should use one prudently to prevent financial instability.When to use a home equity loan

Using a home equity loan can be a strategic financial move in a few situations, such as:- Long-term investments: Since repayment terms can last years, long-term real estate investments are ideal candidates for a home equity loan.

- Debt consolidation: If you have high-interest debts from past property purchases, consolidating them with a home equity loan at a lower interest rate may save you money.

- Emergency expenses: If you need to fund a new home purchase on short notice, your available equity may be able to help secure a house during an emergency.

When to avoid a home equity loan

Unless you’re investing in a home for the reasons above, you may want to consider avoiding a home equity loan a funding options — especially for the following reasons:- Unstable financial situation: If your financial situation is uncertain or if you anticipate a decrease in income, taking on additional debt through a home equity loan may not be advisable.

- Short-term ventures: If you only need funds for a short period, a home equity loan with its long-term repayment plan may not be the most cost-effective solution.

- Risky investments: Using a home equity loan to invest in high-risk ventures can be financially hazardous.

How to get a home equity loan to buy another house

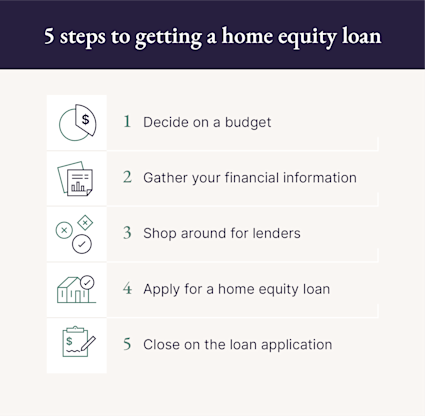

1. Decide on a budget

Before diving into the process of obtaining a home equity loan to purchase another house, it's crucial to establish a clear budget. Assess your current financial situation, including your:- Income: Calculate how much money you’ll earn while the loan repayment terms are active.

- Expenses: Calculate what your estimated expenses will be during the life of the loan.

- Outstanding debts: Have a firm grasp on other debt you must pay off before adding a new loan into the mix.

2. Gather your financial information

Once you have a budget, the next step is to gather all the necessary financial information. This typically includes:- Proof of income: Recent pay stubs may be the most reliable way to verify your current income. W-2 or 1099 forms may also suffice.

- Tax returns: Provide copies of your federal income tax returns for the past two years. Business owners can also provide business returns for the same period.

- Existing mortgage information: Provide statements for your current mortgage detailing the outstanding balance, interest rate and payments.

- Property details: Gather as much information as possible about the second home you intend to purchase with this loan.

3. Shop around for lenders

With your financial information in hand, it's time to explore different lenders and loan options. Shop around to compare:- Interest rates: Search for the best fixed-interest rate loan available. The rate you qualify for depends on your credit score, loan amount and loan-to-value ratio.

- Loan terms: Consider the length of the repayment period. Shorter terms may have higher monthly payments but lower overall interest costs.

- Fees: Understand the additional costs of obtaining a home equity loan with a prospective lender.

4. Apply for a home equity loan

After you've identified a suitable lender, you can initiate the application process. Complete the required forms, provide accurate information and be prepared for additional documentation requests. The lender will likely thoroughly review your financial history, credit score and the value of your primary residence. Timely and transparent cooperation during this stage can expedite the approval process and potentially increase the chances of obtaining a home equity loan on favorable terms.5. Close on the loan application

Upon approval, the final step is a closing meeting to sign the necessary paperwork, which includes the loan agreement and other legal documents. Be sure you fully understand the terms and conditions before finalizing the process to make an informed financial decision. Closing completes the transaction, allowing you to access the funds from your home equity loan.Pros and cons of using a home equity loan to buy another house

As with any kind of loan, there are advantages and disadvantages to using home equity loans to fund your next home purchase.

Advantages of a home equity loan

A home equity loan can offer homeowners a powerful financial tool, providing access to funds based on the equity accumulated in their property.- Increase your down payment size: A larger down payment may enhance your negotiating power and result in better mortgage terms.

- Overcome financing challenges: If you're facing challenges securing financing for a new home, a home equity loan can be a viable solution.

- Lower interest rates: Home equity loans often come with lower rates than unsecured loans or credit cards.

Disadvantages of a home equity loan

Despite the benefits, home equity loans have certain drawbacks. Understanding the potential disadvantages is essential before agreeing to a loan.- Trading assets for debt: A home equity loan involves using your home as collateral, putting it at risk if you cannot meet the repayment obligations.

- Three mortgages for two homes: Juggling multiple loans can be complex, requiring diligent financial management to avoid potential challenges.

- Subject to equity loss: If your equity on your primary home drops, this could affect your ability to finance your second home purchase.

Alternatives to using a home equity loan to buy another house

While a home equity loan is one option for financing the purchase of another house, there are a few other alternatives worth considering.HELOC

A home equity line of credit is a flexible financing option that allows homeowners to borrow against their home equity on an as-needed basis. A HELOC provides a revolving line of credit, allowing you to borrow funds when needed. This can be advantageous for financing a new property since you can draw funds as expenses arise during the buying process. However, managing your borrowing and repayment is crucial to avoid unnecessarily increasing debt.HELOCs often come with variable interest rates, which means your payments will likely fluctuate based on market conditions. While this can lead to potential savings during periods of lower interest rates, it also introduces the risk of higher payments if rates rise.Personal loan

Another alternative to a home equity loan is a personal loan, an unsecured loan that doesn't require collateral. Since personal loans don’t use your home as collateral, you won’t have the risk of losing your property in case of default. While personal loans offer flexibility, they may have higher interest rates than home equity loans or HELOCs. Additionally, the loan amount may be more limited, making assessing whether the funds available meet your property purchasing needs is important.Reverse mortgage

Homeowners over 62 may qualify for a reverse mortgage. A reverse mortgage allows you to convert a portion of your home equity into cash.One unique feature of a reverse mortgage is that repayment is typically not required until the homeowner sells the home, moves out of the home or passes away. Interest accrues over time and is added to the loan balance. See more about Home Equity Conversion Mortgages (HECM) qualifications here.Cash-out refinance

Similar to a reverse mortgage, a cash-out refinance involves refinancing your existing mortgage for a higher amount than you currently owe. You receive the excess funds in cash. It's important to carefully assess the impact of increasing your mortgage amount, as this will result in higher monthly payments and potentially a longer repayment period. Additionally, be mindful of closing costs associated with the refinancing process.Using a home equity loan to buy another house is a simple five-step process that, under the right conditions, can help you afford your next home purchase.Remember to factor in the overall cost of buying another home by factoring in potential down payments, closing costs and future mortgage payments.If being the sole owner of your second home isn’t the direction you want to pursue, consider fractional ownership as an alternative. With Pacaso, you can become a co-owner of a fully managed, turnkey vacation home at a fraction of the price of sole ownership.Home equity loan to buy another house FAQ

01: Can I use home equity to get a different mortgage?

Yes, it’s possible to use home equity to obtain a different mortgage. You can do this through a process called a cash-out refinance.

02: Can I use my house as collateral to buy another house?

Yes, you can use your house as collateral to buy another house. When you apply for a home equity loan, your primary home becomes collateral for your next home purchase.

03: How much equity do I need in my house to get a second mortgage?

According to the Mortgage Reports, you’ll generally need more than 20% equity to qualify for a home equity loan.