Advantages of owning multiple homes

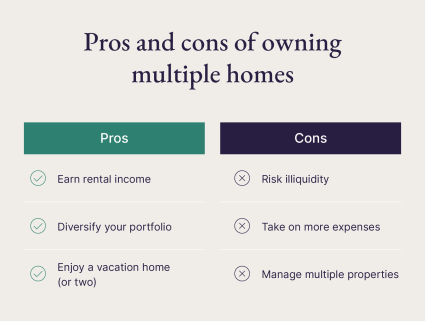

There are many advantages to owning multiple houses, starting with enjoying the perks of having vacation homes accessible to you and your loved ones. It’s important to note that owning multiple homes comes with many responsibilities, such as property management, but the following benefits can make it all worthwhile:1. Earn rental income

Owning multiple homes gives you the opportunity to create a sustainable and passive cash flow stream. Each additional property adds to the total rental income, which can help cover mortgage payments, property taxes, maintenance costs and other expenses associated with owning multiple rental properties.2. Diversify your portfolio

Rental income from multiple homes also offers diversification. It allows investors to spread their investments across various locations and property types, increasing the likelihood of continued cash flow even if one property faces temporary vacancies.3. Enjoy a vacation home (or two)

Perhaps the biggest advantage of owning multiple homes is the freedom to travel and make the most out of your properties. Whether buying a house in another state or down the street, you can indulge in your home away from home at your leisure.Disadvantages of owning multiple properties

Although owning multiple homes can potentially help you earn extra income, diversify your portfolio and grant you access to new vacation spots, there are a few drawbacks to keep in mind. Let’s take a closer look.1. Real estate isn’t liquid

Real estate is generally considered less liquid than stocks, bonds or cash. When you own multiple properties, it can be challenging to quickly convert those assets into cash if needed. Selling a property may require significant time and effort, especially in slower real estate markets, potentially leading to delays in accessing funds. Owning multiple properties can also tie up a substantial amount of capital, limiting diversification opportunities across your other investment assets.2. More homes, more expenses

With each additional property comes a multitude of costs, such as mortgage payments, property taxes, insurance, maintenance, property management and utility bills. These expenses can add up quickly, putting a strain on your finances.If you buy and sell properties frequently, owning multiple properties may also lead to higher transaction costs, such as real estate agent fees and closing costs.3. Managing properties takes time

One significant disadvantage of owning multiple homes is the challenge of property management. As the number of properties increases, so does the complexity and time required to manage them effectively. With multiple homes, the workload and responsibilities can become overwhelming for individual owners, especially if you have to go through your maintenance checklist in different locations.

Key considerations for owning multiple homes

Buying a second home for investment can be a rewarding strategy with careful planning. Here are some things to consider before taking the leap:1. Financing options

Financing for multiple homes can vary depending on individual financial situations and investment goals. Traditional mortgages are common, but they may become limited as the number of properties increases. Here are a few ways you can buy multiple properties:- Pay in cash: If possible, paying in cash avoids the headaches of financing.

- Apply for (another) mortgage: Even second and third homes can qualify for traditional mortgage financing.

- Apply for portfolio loans: If you’re interested in buying an investment property, you can qualify for portfolio loans through your lender.

- Form an LLC: Forming an LLC may qualify you for real estate investment loans and less expensive buy-ins due to fractional ownership.

- Leverage existing home equity: Consider using the equity in your primary residence to help finance your other home purchase.

2. Property management

By renting out the property to tenants, you can offset some of the ownership costs, such as mortgage payments, property taxes and maintenance expenses, while building equity in the property. However, successful rental income generation requires proper property management, including tenant screening, regular maintenance and prompt response to tenant needs. With careful planning and a proactive approach, using a second home as a rental investment can offer an attractive source of passive income.| Tip: Don’t just go with the first property management company that pops up on Google. Look for one with a strong local presence, transparent pricing, and tech tools that let you monitor things remotely. Bonus points if they specialize in second homes — think Pacaso. |

3. Tax implications

Depending on how you’ll use the property, the tax considerations differ. Here’s a quick rundown:- Primary residence: Homeowners may benefit from capital gains exclusions when selling.

- Rental properties: Rental income generated from investment properties is taxable, but it opens the door to various deductions, including property-related expenses and potential depreciation.

- Vacation homes: Second homes used for personal enjoyment may have limited tax benefits, with deductions subject to strict usage rules.

Tips for managing multiple homes

The goal is to co-own homes without the hassle. Here’s the checklist you need to keep everything ready and organized:- Use a property management company to handle day-to-day operations.

- Install smart home security systems for remote monitoring and alerts.

- Automate recurring payments like utilities, insurance and HOA fees.

- Create seasonal checklists to prep homes for peak and off-seasons.

- Schedule routine maintenance ahead of time, especially for vacant homes.

- Create a digital home binder for each property, including vendor contracts and warranties.

Want a second home without the full-time costs?

The weekend escapes, the family holidays, the familiar getaway spot — the idea of a vacation home sounds divine. Second homes come with a lot of perks, but also plenty of responsibilities. Between the upfront costs, ongoing maintenance, and time spent managing the property, full ownership isn’t the right fit for everyone.That’s where Pacaso comes in.Pacaso makes second home ownership more accessible by offering co-ownership of luxury homes in top destinations. With multiple people buying a house instead of buying 100% of a home on your own, you’ll only use part-time, and you buy the share that fits your lifestyle. Your shares may be from 1/8 to 1/2 ownership, with real equity, not just a timeshare.Here’s why Pacaso is a smarter way to own multiple homes:- Lower barrier to entry: Own a second home for a fraction of the cost of buying outright.

- Fully managed: Pacaso handles everything: maintenance, repairs, cleaning, and even furnishing the home.

- Easy scheduling: Use the Pacaso app to book stays with a few taps. Your time is guaranteed and fair.

- More destinations, more freedom: Want a lake house and a beach condo? You can co-own homes in multiple locations without juggling the full costs and responsibilities of each.

Co-own multiple homes with ease

Now that you’ve got the full picture of how co-owning property works, you can decide if co-ownership is a good option within your lifestyle and budget. Through this model, you can own a second home, pay for the time your family uses it, and share the cost of ownership among other like-minded buyers. And unlike a timeshare, this model offers real estate ownership. And with a fully managed co-ownership program like Pacaso, co-owning a second home becomes easy and hassle-free.Owning multiple homes FAQ

01: How many mortgages can you have?

The number of mortgages you can have depends on your financial situation, creditworthiness and the lender's policies. Technically, there is no set limit, but each additional mortgage may become more challenging to obtain due to debt-to-income ratio restrictions.

02: How many rental properties can you own?

The number of rental properties an individual can acquire depends on their financial capacity, investment goals and ability to manage the properties effectively. In theory, as long as an investor can afford the down payments, mortgage payments and maintenance costs, they can continue acquiring rental properties.

03: Is owning multiple homes a good investment?

The answer depends on various factors, like the potential for generating rental income, your current financial commitments and your ability to maintain multiple properties.

04: Why would someone own multiple homes?

Owning multiple homes can potentially generate rental income or provide your household with an exclusive vacation home. Having multiple homes also allows for a variety of destinations, providing the flexibility to enjoy different climates and experiences throughout the year. On top of that, co-ownership of a second home can reduce the financial burden of owning multiple homes on your own.

05: How can I manage multiple properties effectively?

If you own more than one home and find it difficult to manage them effectively, consider hiring a property manager to maintain your properties.