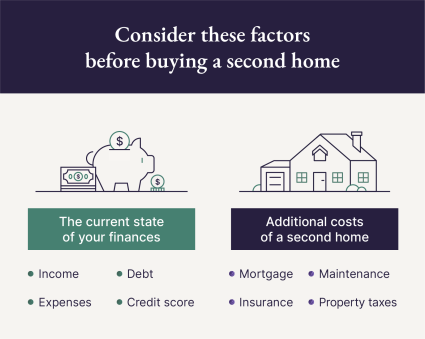

1. Assess your financial situation

- Income: Examine your current and projected income to determine if you can comfortably support the additional financial responsibilities of owning a second home.

- Expenses: Conduct a comprehensive analysis of your existing expenses and potential additional costs of a second home, ensuring you clearly understand your overall financial commitments.

- Debt: Evaluate your existing debt obligations, considering credit card balances, car loans and any outstanding loans. This will help determine if taking on a second mortgage will strain your ability to repay your debt.

- Credit score: Check your credit score and history to assess your creditworthiness. A higher credit score may secure better mortgage terms and interest rates.

- Mortgage: Carefully consider your mortgage options. Compare interest rates and terms to find mortgage terms that align with your financial goals and ensure sustainable payments over the life of the loan.

- Property taxes: Check local tax rates and regulations to accurately estimate the ongoing financial commitment.

- Maintenance: Assess the potential maintenance costs of the second home, including routine repairs and unforeseen issues. Confirm that you have the financial capacity to keep the property in good condition.

- Insurance: Obtain comprehensive insurance coverage for your second home, factoring in property value, location-specific risks and liability protection to safeguard your investment.

2. Source funding for another down payment

When researching how to buy a second home, you'll come across several ways to source down payments. Here are a few resources if you want to begin buying a house without selling yours first.HELOC

Using a home equity line of credit (HELOC) for a second home purchase allows you to leverage the equity built up in your primary residence to secure financing. This is a potentially great option if you want to learn how to buy another house while already owning a house.| Pros | Cons |

| HELOCs often come with lower interest rates compared to other options. | They are subject to variable interest rates, so payments can fluctuate. |

| You can access funds as needed and only pay interest on the amount you use. | Using a HELOC puts your primary residence at some risk, as it's used as collateral. |

Retirement accounts

Did you know that you can potentially make penalty-free withdrawals from your retirement accounts to secure down payment funding towards a home purchase? Here’s how tapping into your retirement accounts works:- Traditional IRA: Initial home purchasers can withdraw up to $10,000 from their IRA without incurring a 10% penalty. However, taxes are applicable on the withdrawn sum.

- Roth IRA: The same penalty-free rules apply. However, withdrawals of contributions (money you've already paid taxes on) are more flexible.

- 401(k): A first-time homebuyer can make 401(k) withdrawals of up to $10,000 that are penalty-free. You can also take out a loan against your 401(k) to fund a down payment.

| Pros | Cons |

| First-time home buyers may qualify for penalty-free withdrawals up to $10,000. | The more funds you withdraw, the less you have for retirement. |

| This is a low-risk option if you have plenty of time before retirement. | You'll face expensive fees if you do not qualify for penalty-free withdrawals. |

Cash

Saving up cash to fund the down payment for your second home is an ideal financial strategy. Paying in cash is risk-averse, provides greater flexibility and reduces reliance on external financing. You can build a substantial down payment over time by consistently setting aside a portion of your income into a dedicated savings account. This may also help you to negotiate better mortgage terms.| Pros | Cons |

| Offering cash for the down payment can strengthen your negotiating position. | Using a large amount of cash for a down payment can reduce your liquidity. |

| Sellers often prefer cash transactions as they are more straightforward. |

Family gifts

You can apply a monetary gift from a family member towards the down payment of your second home. However, it's essential to navigate this arrangement with transparency and communicate the stipulations of accepting family gifts for a home purchase. For example, the gift giver must:- Complete a gift letter: A gift letter is a formal document that outlines the giver's intention to provide a financial gift without expectation of repayment, serving as a crucial piece of documentation for the real estate transaction.

- Provide bank statements: When using a family gift payment, you’ll need to provide statements from the donor demonstrating the origin of the funds.

- Know it’s not a loan and can’t be repaid: The donor must know that repayment is unacceptable if the sum is given as a monetary gift.

| Pros | Cons |

| You will not have to repay the gift like you would a traditional financing option. | Gifts can sometimes lead to strained relationships or unspoken expectations. |

| You will not pay interest on the gift. | You’ll need to file additional paperwork with your lender. |

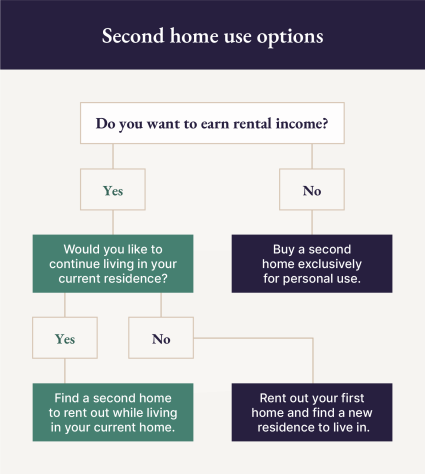

3. Decide how both homes will operate

Renting out your current home

Are you hoping to find a new primary residence so you can rent out your current home? If so, you’ll need to keep the following factors in mind:- Rental income potential: Research rental prices in your area for comparable homes and locations to understand if the potential income is enough to keep your finances secure as you purchase a second home.

- Condition of your current home: Assess the condition of your current home to avoid major problems as you transition into becoming a landlord.

- Local zoning laws: Double-check your community guidelines regarding short-term or long-term rentals.

Investing in a vacation rental

You may want to continue living in your primary residence and find a second home that works well as a short-term vacation rental. If that’s the case, consider the following:- Property location: The location of your vacation rental can drastically affect its appeal to potential renters. Search for rental properties that are near sought-after destinations and amenities.

- Seasonal demand: The rental income you can expect to generate from your rental can change with the seasons. Have a firm grasp of seasonal demand to accurately estimate a home’s rental income potential.

- Local competition: Scope out how many rentals you’d be competing with to gauge what your nightly rates should be and how you can differentiate yourself from your competitors.

- Local zoning laws: Double-check community guidelines regarding short-term rentals.

4. Research tax implications

For tax purposes, you’ll need to define each of your properties as one of the following property categories:- Primary residence: This is the home where you live most of the time. It’s typically the place you consider your main home, where you are registered to vote and receive mail.

- Mixed-use property: This property can combine residential and commercial uses. This can potentially include a building with both living space and commercial storefronts.

- Investment property: The primary goal of this property is generating income or appreciation. This category includes properties like rental homes and short-term vacation rentals.

- Mortgage interest: You may be able to deduct mortgage interest payments on loans. This can apply to primary and second residences, offering potential tax savings for the mortgage used to finance the second property.

- Property taxes: Property taxes paid on a second home are typically deductible on your federal income tax return.

- HELOC deduction: If you use a HELOC to finance improvements or other qualified expenses for a second home, you likely can deduct the interest.

- Rental expenses: If you rent out your second home, you can deduct some rental expenses like property management fees, maintenance costs and utilities. However, it's crucial to distinguish between personal and rental use to accurately claim these deductions.

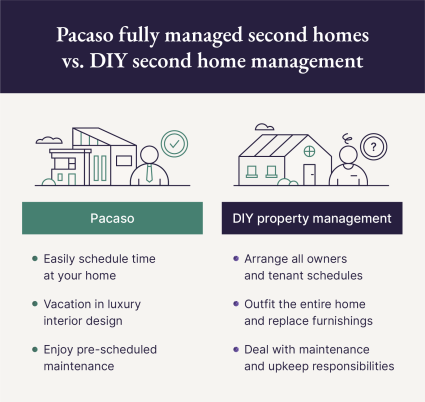

5. Organize property management (if necessary)

- Decide who will manage your property: Evaluate whether you will self-manage your home or homes, or hire a professional property management service. Consider the costs in terms of both time and money.

- Ensure the property is well-maintained: Keep both your primary and secondary homes in good condition, addressing repairs promptly and conducting regular inspections.

- Stay aware of local rental laws: Inform yourself about both properties' local rental laws and regulations. Understanding tenant rights, eviction procedures and other legal aspects helps you manage the properties.

- Market your rental property: Learn how to market and advertise your property to effectively attract tenants and avoid as many vacancies as possible.

- Prepare for potential vacancies: When vacancies do occur, have a financial plan for maintaining your rental property without rental income flowing in.

Fully-managed vacation homes

If you want to enjoy your second home as a hassle-free vacation home, then consider opting for a fully-managed property. No need to worry about property management or rental income potential when you go this route.Hassle-free second home ownership

See allHow to buy a second home without selling the first FAQ

01: How can I buy another house without selling my first?

To buy another house without selling your first, explore options such as obtaining a HELOC or line of credit on your existing property. These approaches leverage the equity in your current home to fund the purchase of a second property.

02: How much do you need for a downpayment on a second home?

The down payment for a second home typically ranges from 10% to 20% of the home's purchase price, although the exact amount varies based on factors like the lender's requirements, loan type and your credit score.

03: Can I convert my primary residence to an investment property?

Yes, you may convert your primary residence into an investment property. However, doing so may have financial and tax implications. It's important to consider rental income, property management and potential capital gains taxes. Consult a financial advisor or tax professional beforehand.

04: Is it easier to buy a second home than the first?

Buying a second home can be easier than the first for some individuals, as they may have established equity and gained experience in the home buying process.