What is a letter of explanation?

A consumer explanation letter, also known as a "Letter of Explanation," is a concise document designed to clarify specific aspects of someone’s financial or employment history. Letters of explanation are particularly useful when an underwriter has concerns during the loan or mortgage application process. It addresses issues such as past bankruptcies or gaps in employment, ensuring a transparent and comprehensive understanding of the applicant's financial standing.Underwriters examine your financial history and determine if you qualify for the home loan you’re applying for. Since loan applications don’t include space for explanations, an underwriter may request that you submit a letter of explanation as evidence that you meet the funding criteria.

Why do you need a letter of explanation?

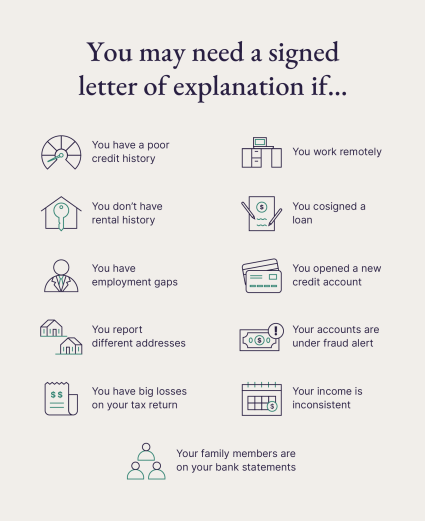

There are several reasons why an underwriter or mortgage lender may request a signed letter of explanation, particularly when it comes to a second home mortgage. Most pertain to gaps in employment, rental history or on-time payments. Here are some of the most common reasons you may need to write a letter of explanation1. You have a poor credit history

Your credit history helps lenders know how you’ve handled debt in the past. The following red flags can potentially indicate poor debt management and may require a letter of explanation:- Late payments

- Bankruptcy

- Foreclosures

2. You don’t have rental history

Ideally, lenders want to see that you have a consistent rental history for the last 12 months. This reassures them that you will be able to handle regular mortgage payments. If you have a gap in your rental history, explain the cause. Caring for a family member or recovering from an accident are possible explanations for a rental hiatus.3. You have employment gaps

Similar to your rental history, lenders prefer to see consistent employment in the year before your loan application. This shows the lender that you have the income to make regular mortgage payments.A lender can be flexible when they know more about the circumstances that led to an employment gap. Being laid off or raising children are possible explanations for the lack of recent work experience.4. You report different addresses

If the address on your driver’s license does not match the address on your loan application or credit report, a lender may ask you to explain the discrepancy.5. Your income is inconsistent

Underwriters will carefully review your income. If it fluctuates often, they may request an explanation letter. If you are self-employed, your accountant may also have to write a letter of explanation to verify how you generate your income. You might also find it helpful to use a second home mortgage calculator to estimate your potential payments.6. You work remotely

If your remote career is tied to an address in a city or state that is different from where you are buying a home, especially if that home is intended to function as a second home office, a lender may request that your company provide a letter of explanation verifying that your career (and income) will not be affected by your move. This situation is becoming increasingly common with the rise of “Zoom towns”.7. You have substantial losses on your tax return

If you are a self-employed business owner or independent contractor, it’s normal to file losses on your first few tax returns. A lender may request a letter of explanation to ensure that these losses will not be consistent and will not affect your ability to make regular mortgage payments.8. You cosigned a loan

In the event that you cosigned a loan, a lender will want an explanation letter ensuring that you are not the one making the payments. This can apply to student loans, auto loans and mortgages, even for a second home or investment property.9. You opened a new credit account

If you open a new credit account while applying for a mortgage loan, a lender may suspect that the debt could affect your ability to repay your loan. Remember that the underwriter will also review your finances during closing, so hold off on opening new lines of credit until the sale is complete, if possible.10. Your family members are on your bank statements

If multiple people appear on your bank statements, like parents or children, you will need to write a letter explaining that you’re in control of the funds being used to pay for your new home. Anyone who helps you with the down payment of the home will also be responsible for writing a gift letter of explanation.11. Your accounts are under fraud alert

A lender will want to know that you’re aware of any suspicious activity on your credit report. If your accounts are under fraud alert or your credit is frozen, prepare a letter of explanation that outlines how you will regain control of your finances.

How to write a letter of explanation

Before you write a mortgage letter of explanation, you’ll need some information first. Some of this you’ll have readily available (like your name), but you might have to gather or research other details, such as specific dates or documentation related to the situation you're explaining.Some of the common pieces of information you’ll need include:- Your full legal name

- Your spouse's full legal name (if applying together)

- Your current mailing address

- The address of the lender

- Your phone number

- Marriage license, if applicable

- Bills of sale (for large assets like a car)

- Title transfers

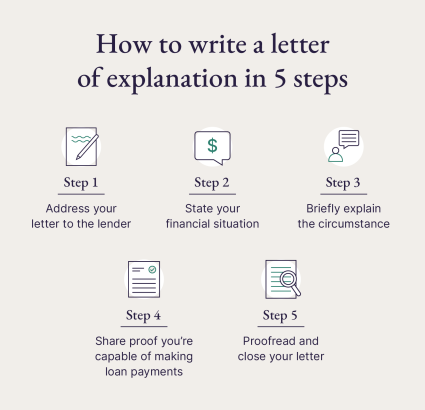

- Address your letter: Write the date and lender’s address at the top of the explanation letter, then address the lender or lending institution.

- State your financial situation: Be upfront about your financial issues. Your application already indicates something suspicious to your lender, so there’s no need to hide the truth. Quickly state the fact of the matter and proceed.

- Briefly explain the circumstance: Keep your letter as concise as possible. After you state the problem, provide a short explanation of the circumstances around your issue.

- Share proof that you’re prepared: After you explain your financial situation, provide the lender with evidence that you are now capable of buying a house.

- Proofread and close your letter: Check your letter of explanation for any spelling or grammatical errors. Ensure that the tone of your letter is professional and courteous, then close the letter with your full name and current address.

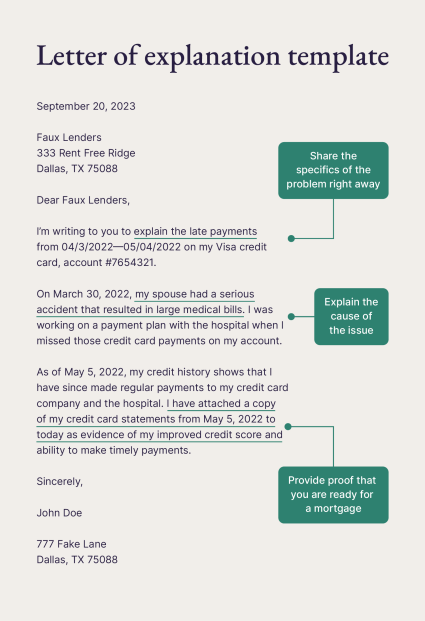

Letter of explanation template

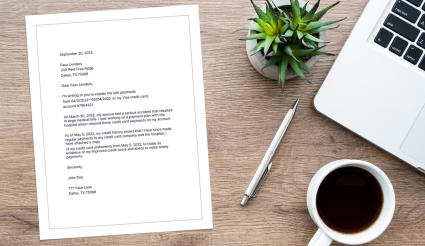

A credit letter of explanation request is no cause for panic. Here is a letter of explanation example to help point you in the right direction:| September 20, 2025Faux Lenders 333 Rent Free Ridge Dallas, TX 75088Dear Faux Lenders,I’m writing to you to explain the late payments from 04/03/2025-05/04/2025 on my Visa credit card, account #7654321.On March 30, 2025, my spouse had a serious accident that resulted in large medical bills. I was working on a payment plan with the hospital when I missed those credit card payments on my account. As of May 5, 2025, my credit history shows that I have since made regular payments to my credit card company and the hospital. I have attached a copy of my credit card statements from May 5, 2025, to today as evidence of my improved credit score and ability to make timely payments.Sincerely,John Doe 777 Fake Lane Dallas, TX 75088 |

- Address it to the correct party. Ensure your letter is addressed to the correct individual or department. Misdirection can cause delays and frustration.

- State the purpose early. Begin your letter by clearly stating why you are writing it. This immediately sets the context for the reader and helps them understand what to expect.

- Be clear and concise. Get straight to the point and avoid unnecessary jargon or overly complex language. Your goal is to explain the situation clearly and efficiently.

- Provide specific details. Back up your explanation with concrete facts, dates and any relevant documentation.

- Maintain a professional tone. Even if the situation is frustrating, maintain a respectful and objective tone. A calm and professional tone conveys maturity and seriousness.

- Take responsibility. If the explanation involves an error or oversight on your part, acknowledge it directly and avoid making excuses. This demonstrates accountability and can build trust.

- Offer a solution or mitigation. If possible, suggest steps you have taken or plan to take to address the issue or prevent its recurrence. This shows initiative and a commitment to resolving the situation.

- Proofread carefully. Read your letter multiple times and consider having someone else review it for clarity and accuracy.

- Keep a copy for your records. Always retain a copy of the letter you send and any supporting documents. This can be important for future reference or if further clarification is needed.

Letter of explanation FAQ

01: What is a letter of explanation for a mortgage lender?

A letter of explanation clarifies negative marks on your credit report and assures an underwriter or lender that you are capable of paying off a mortgage.

02: What is a credit letter of application?

A credit application is a formal request from an individual or business to a lender for a loan or line of credit. It includes personal and financial details that help the lender decide if the applicant can repay the money.

03: How can I explain late payments or a mortgage loan application?

If you need to explain late payments on a mortgage application, be honest and specific about why they happened, like a job loss or medical issue. Crucially, explain how you've fixed the problem and what you're doing to avoid it in the future. Including documents to support your explanation and show you're financially stable now can help.

04: How long should a letter of explanation be?

A letter of explanation should be as brief as possible, consisting of three paragraphs that span no more than three-quarters of a page.

05: What is a letter of explanation address verification?

You’ll need to send a letter of explanation address verification to your lender if your current physical address does not match the address on your mortgage application or credit report.