Trends showing now might be a good time to buy a new home

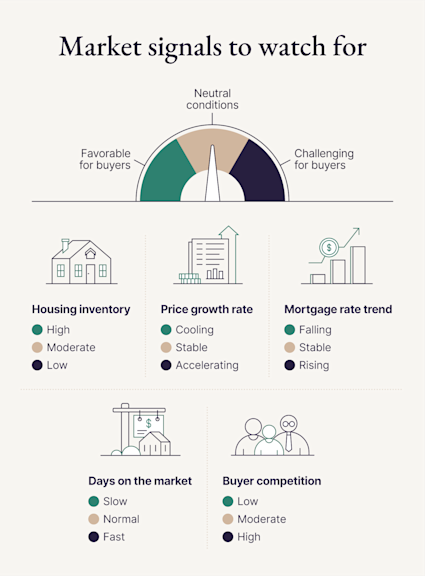

Despite uncertainty, there are solid reasons to feel optimistic about buying a home in 2025:- Inventory is up: According to the Federal Reserve Bank of St. Louis, active listings neared 1 million this year across the United States, almost double from the low inventory crisis of 2022.

- Slower home price growth: Price hikes have cooled in many markets, signaling a potential plateau.

- Mortgage rates are dipping slightly: Some lenders are offering rates in the low 6% range, with predictions of 5% rates on the horizon.

- New builds on the rise: Housing starts are up 1.6% from revised March numbers, which is a hopeful sign for future buyers.

- Negotiation is back: With fewer bidding wars, buyers have more leverage on price, repairs and closing costs.

| Pro tip: If you’re eyeing a second home, 2025 could be your year to secure it on more favorable terms. Browse the best house-buying websites and the spring 2025 housing market breakdown for additional insights. |

Trends indicating now might be a bad time to buy a new home

As it usually goes, things aren’t black and white. These market realities might give you pause:- Home prices are still steep: According to the Federal Reserve Bank of St. Louis, the median price sits near $420,000, up sharply from just five years ago.

- Rates remain elevated: While better than 2023, mortgage rates are hovering around 6.8% nationally.

- Inventory gaps persist: Despite growth, housing supply hasn’t fully recovered, especially in high-demand areas.

- Inflation is lingering: Higher costs across the board stretch home-buying budgets thinner.

- Uncertain economy: Global economic instability and inflation remain hot topics in 2025, with differing opinions on the matter.

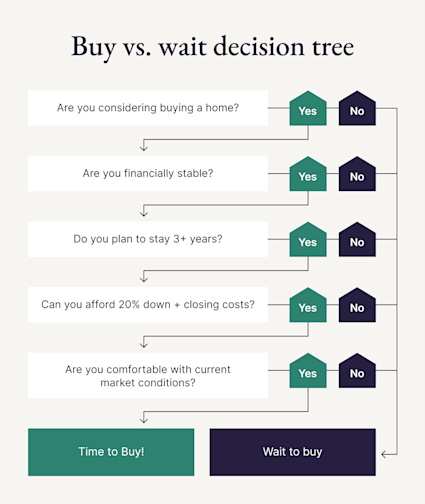

Questions to ask yourself before buying a house

Even though the market seems to move slowly, this could be your opportunity to purchase a home. Whether it is a good time to buy a house really depends on your situation. So, take a moment to answer the following questions:

Am I financially stable enough to purchase a home?

Purchasing a home is a large financial commitment, and lenders will examine your financial history and stability before deciding to give you a loan. This includes looking into your employment history: basically, how long you’ve been in your current job and the likelihood of you keeping it in the future. Review the following elements before you decide to buy a home:- Debt: Loans and credit card debt can take away from your housing budget. Attempt to pay off your debt before applying for a home loan.

- Credit score: Your credit score will help determine what kind of funding opportunities you have while financing a new home. Aim for a credit score above 620, although a score above 740 would be ideal.

- Savings: Before purchasing a home, reflect on how much money you need for an emergency fund and set it aside from your housing budget.

- Investments: Ideally, you want to be financially secure enough to contribute to a retirement account and other investments before purchasing a home.

How long will I live there?

A house is a real estate asset, so you should consider how long you plan to keep your property. Mortgages can come with a 15- or 30-year fixed interest rate, so think about your lifestyle and future expectations before deciding on this commitment. After all, there are different considerations when buying a family home you intend to live in for many days to come versus purchasing an apartment you intend to move out of in a few years. If this purchase will be your new primary residence, there might be additional funding opportunities for you to explore. However, if you want to buy a second home to visit occasionally, factor other expenses, such as property management, into your budget.What can I afford to spend on a mortgage?

There are several factors that contribute to the cost of owning a home, but your mortgage payment will most likely be the largest chunk of your housing costs. Review the following expenses while determining if now is the time to buy a house:- Interest rates: As of this writing, the current average is 6.87%.

- Property taxes: Depending on the state and property value, your taxes can range from the hundreds to a few thousand.

- Insurance: The cost may vary according to your needs. However, the national average is $2,341 per year, coming to around $195 a month.

- HOA fees: This monthly fee is subject to change, depending on the area and amenities the community provides. Always ask about this before purchasing.

- Maintenance: These costs vary depending on the size and features of your home. Considering this, it might be wise to set aside around $6,000 a year to cover these unavoidable costs.

- Property management: If you are looking into a second home, property managers can help ensure your home is taken care of. With Pacaso second home ownership, our expert team of property managers helps with maintenance, daily upkeep and more.

Do I have enough for a down payment and initial costs?

Although you can finance most of the mortgage, you’ll still be responsible for providing around 20% of the purchase price upfront. Depending on the cost of a home, primary and second home down payments can range from $10,000 to well over $100,000. While it is possible to find additional funding for down payments, this will increase your monthly payments. Try to save up the cost of the down payment before buying a home.Taking these costs into account is one of the most critical steps in buying a house. Take time to budget for these additional costs:- Closing costs: These costs include lender fees, home appraisal, home inspection and title costs, among others. You can negotiate these with your lender, but the buyer usually needs to pay around 2% to 5% of the home sale’s price upfront.

- Reserves: Lenders may require homeowners to show proof that their savings won’t be drained after buying a home. It’s good to have at least two months of mortgage payments in reserve.

- Moving: If you plan to move into your new residence or furnish your second home, list your requirements and budget accordingly. Relocation costs can add up.

Will I get a favorable rate?

Interest rates depend on a few factors, such as your employment record and credit score. So, is this a good time to buy a house if I want a low rate? Let’s check your credit score first. Remember that you’ll probably need a score of at least 620 to get approved for a mortgage. If you want the best mortgage interest rates, try to boost your credit score to 740 or more. The best way to do this is by paying your bills on time and paying off your credit cards and other debts. If you need to maintain a balance, keep it under 30% of your income to maintain a low debt-to-income ratio.How will this affect my future financial goals?

Take stock of your future financial goals and reflect on how buying a house could affect them. If you’ll be financing your home, remember that you’ll have significant housing costs that may require you to curtail savings for things like children’s education and retirement. What’s more, these housing costs could require you to sacrifice aspects of your current lifestyle, like vacations and spending habits. Think about potential lifestyle changes or if you are comfortable putting larger goals like owning a second home on hold.What is motivating this purchase decision?

Whether this purchase is for your first or second home, consider what is motivating this special investment. Potential answers could include:- I’m ready to stop paying rising rent prices.

- My family is growing, and I need more space.

- I want to live in a specific neighborhood.

- I want to be closer to good schools.

- I’m ready to buy a vacation home.

- I want to make memories with my loved ones.

Should I wait to buy a house?

Waiting might not get you a better deal if your finances and goals currently align. Buying now can help you build equity sooner and avoid the rising prices that typically come after a dip in interest rates. And that’s without considering you’ll be living your dream soon. Yes, some buyers are hoping for a recession dip. With interest rates and home prices still high, some might be thinking, “Is it a bad time to buy a house?” But here’s the thing: Waiting doesn’t always work how you think it will. When rates drop, competition usually explodes. That can push prices back up just as fast.In the end, personal readiness matters more than market headlines. Don’t ignore the market entirely or let fear of missing the perfect timing stall your life goals.Try before you buy forever

Still not sure if this is your moment? Consider PacasoNow, a service that lets you experience second home living before fully committing. Whether you’re looking for a weekend escape or exploring a future full-time move, trying before buying can offer clarity. We can help you answer the question, “Is now a good time to buy a house?”If you want to research a bit more to help you decide, visit our guide on buying a house in another state or renting vs. buying.House buying FAQ

01: Would waiting for lower mortgage rates save me more money in the long run?

It depends. A 1% drop in rates could save thousands in interest. However, if prices rise during that time, it may cancel out your savings. Crunch the numbers based on your loan size.

02: How might a recession impact my decision to buy a house now or later?

During recessions, interest rates often fall to spur demand. On the other hand, that demand can cause prices to rebound fast. If you’re financially stable now, waiting might cost more.

03: Should I buy now if I want to avoid increased competition in the market?

It could be a good move to buy now to avoid competition in a market with lower interest rates. As rates continue to fall and housing shortages drop, buyer activity will likely rise.