| Short-term rental definitionA short-term rental is a furnished living space available for short periods, from a few days to six months. They are considered an alternative to a hotel. |

Understanding short-term rentals

Over the last 10 years, vacation rental brands like Sonder and Airbnb have exploded in popularity. Staying in short-term rentals is so common that many companies allow employees to expense their stays — just like a hotel room.Homeowners choose a short-term rental strategy for income potential, marketing automation, flexibility and tax benefits. Short-term rentals require less commitment than their long-term counterparts. A vacation rental can work well if the homeowner wants to also enjoy the home themselves. Seasonality, however, can also play a part in whether a rental will be in demand — meaning owners might have to give up personal stays during the most popular times of the year. Owners are also responsible for cleaning, coordination and maintenance to keep the short-term rental property in guest-ready condition.How short-term rentals work

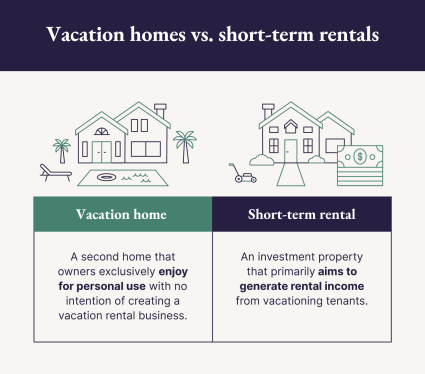

Many people who buy a second home or vacation property generate income by renting out their home when they’re away. On the other hand, homeowners can also buy investment properties to generate short-term rental income year-round.

What’s considered a short-term rental in each state?

Local restrictions are a critical factor for anyone considering owning multiple homes. Each city or county defines what qualifies as a short-term rental property, and the fees can be hefty for homeowners who rent under the radar.Short-term rental qualifiers by state

| State | Length of stay maximums | Local regulations |

| Alabama | 30 consecutive days or less | Requires a zoning certificate |

| Alaska | 30 consecutive days or less | Requires a business license |

| Arizona | 30 consecutive days or less | Subject to Arizona transaction privilege tax (TPT) |

| Arkansas | 30 consecutive days or less | Requires an STR business license |

| California | 30 consecutive days or less | Requires a business license |

| Colorado | 29 consecutive days or less | Requires an STR license |

| Connecticut | 90 consecutive days or less | Requires a zoning certificate |

| Delaware | 150 consecutive days or less | Requires an occupational license |

| Florida | 181 consecutive days or less | Requires zoning approval |

| Georgia | 30 consecutive days or less | Requires an STR license |

| Hawai’i | 30 consecutive days or less | May only be permitted in resort-zoned areas |

| Idaho | 30 consecutive days or less | Requires an STR license |

| Illinois | One month or less | Requires a zoning permit |

| Indiana | 29 consecutive days or less | Requires a zoning permit |

| Iowa | 30 consecutive days or less | Requires a zoning permit |

| Kansas | 30 consecutive days or less | Requires rental registration |

| Kentucky | 30 consecutive days or less | May require a conditional use permit |

| Louisiana | 30 consecutive days or less | Requires an STR permit |

| Maine | 30 consecutive days or less | May require a minimum of two nights |

| Maryland | 90 consecutive days or less | Requires a rental license |

| Massachusetts | 31 consecutive days or less | Requires a rental license |

| Michigan | 30 consecutive days or less | Requires a rental license |

| Minnesota | 30 consecutive days or less | Requires a zoning permit |

| Mississippi | 30 consecutive days or less | Requires rental registration |

| Missouri | 31 consecutive days or less | Requires a rental permit |

| Montana | 30 consecutive days or less | Requires a zoning permit |

| Nebraska | 29 consecutive days or less | Requires an STR license |

| Nevada | 30 consecutive days or less | Requires an STR license |

| New Hampshire | 30 consecutive days or less | Requires a zoning permit |

| New Jersey | 30 consecutive days or less | Requires a seasonal certificate of occupancy |

| New Mexico | 29 consecutive days or less | Requires an STR permit |

| New York | 30 consecutive days or less | Requires rental registration |

| North Carolina | 30 consecutive days or less | Requires a zoning permit |

| North Dakota | 29 consecutive days or less | Requires a sales and use tax permit |

| Ohio | 29 consecutive days or less | Requires an STR permit |

| Oklahoma | 29 consecutive days or less | Requires an STR license |

| Oregon | 30 consecutive days or less | Requires an STR permit |

| Pennsylvania | 30 consecutive days or less | Subject to the hotel occupancy tax |

| Rhode Island | 30 consecutive days or less | Requires rental registration |

| South Carolina | 29 consecutive days or less | Requires rental registration |

| South Dakota | 14 consecutive days or less | Requires a conditional use permit |

| Tennessee | 30 consecutive days or less | Subject to local occupancy tax |

| Texas | 30 consecutive days or less | Requires a zoning permit |

| Utah | 29 consecutive days or less | Requires an STR permit |

| Vermont | 15 consecutive days or less | Subject to the local option tax |

| Virginia | 30 consecutive days or less | Requires a special use permit |

| Washington | 29 consecutive days or less | Requires liability insurance |

| Washington D.C. | 30 consecutive days or less | Requires an STR license |

| West Virginia | 29 consecutive days or less | Requires a business license |

| Wisconsin | 180 consecutive days or less | Requires a DATCP license |

| Wyoming | 29 consecutive days or less | Requires a basic use permit |

| Example: John lives in Austin, Texas, and rents out a garage apartment during South by Southwest, a festival that fills the city’s hotel rooms. His property is registered and licensed with the city to allow stays under 30 days in length. |

Types of short-term rentals

Many vacation rental sites allow you to filter the type of short-term rental options you can browse through. The three main types of vacation rentals are entire homes, accessory dwelling units (ADUs) and individual rooms.

Entire homes

Example: A beachside retreatAirbnb and Airbnb alternatives list entire homes that double as seaside sanctuaries, mountain retreats and urban oases. The key component of qualifying as an entire home is that the rental must have a living area, bathroom and cooking space separate from shared spaces.Accessory dwellings

Example: A backyard cottageAccessory dwellings are sometimes known as in-law suites because they often take the form of cozy detached studios complete with an en-suite bathroom and comfortable furnishings — perfect for when the parents are in town. An ADU is generally on the same property as the primary residence and can potentially include a private entrance.Rooms

Example: A private guest suiteSome jurisdictions allow homeowners to rent out a room in their primary residence as a short-term rental. The room can serve one or multiple guests at a time and can potentially include access to shared spaces like a kitchen or yard. Like an accessory dwelling, private rooms can sometimes include private entrances.Comparing long-term to short-term rentals

Both short-term and long-term rentals are investment properties that homeowners can use to generate rental income. The length of the lease between owner and tenant often determines which type of rental agreement both parties will abide by.A long-term rental is generally a lease agreement for tenants who live at a rental property for at least 90 days, although some landlords require a minimum of 180 days or a full calendar year. A short-term rental, however, is generally available to lease for less than 30 consecutive days.| Short-term rentals | Long-term rentals | |

| Furnishings | Furniture required | Typically unfurnished |

| Tenant responsibilities | Light cleaning may be necessary | Moderate maintenance may be necessary |

| Utility payments | Utility costs are built into rental rates | Tenants generally pay for utilities independently |

| Vacancies | Seasonal vacancies are possible | Potentially fewer vacancies |

Considerations before investing in short-term rentals

Short-term rentals require homeowners to abide by local vacation rental rules and regulations. There are several factors to consider before investing in a vacation rental.

- Ensure property zoning allows short-term rentals: Check your local state, city or county website for specific short-term rental guidelines.

- Register for appropriate licenses: You may need to obtain a permit or license before earning income from your rental.

- Report business income: Operating a short-term vacation rental business means you assume the responsibility of reporting your income and expenses.

- Budget for additional taxes: Create a financial plan that accounts for the appropriate tax payments.

- Manage and maintain your rental property: You may need to hire a property manager or schedule time to manage and maintain your vacation rental.

What is a short-term rental FAQ

01: How do I know if my city allows short-term rentals?

Do a Google search for your city name and “short-term rentals.” Airbnb has gotten so popular that most local governments devote a section of their website to licensing FAQs.

02: What kind of properties qualify as a short-term rental?

It depends on what your city allows. Some local governments allow whole homes to be leased as short-term rentals, while others restrict residents from leasing anything larger than a single room. In some cities, homeowners can rent something as small as a renovated Airstream trailer or a “structure” in their backyard.

03: What is the shortest time you can rent a property?

Your local jurisdiction will determine the shortest time you can rent a property you classify as a short-term rental. Generally, guests must book your vacation rental for one or two nights minimum.

04: What are the risks of a short-term lease?

Potential risks of a short-term lease can include low-season vacancies and keeping up with the latest market pricing. Unlike long-term leases, a short-term lease may require more tenant management and communication.