What is tenancy in common (TIC)?

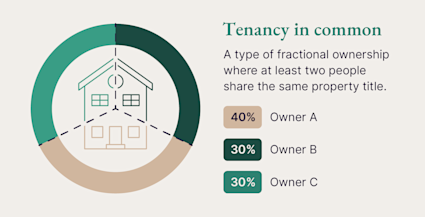

Tenancy in common is a home ownership model that allows multiple individuals to own a single property, each holding a distinct share. Unlike joint tenancy, these shares don't have to be equal, making TIC a flexible option for diverse groups of varying income levels or investments. TIC agreements are usually very detailed, addressing various potential conflicts through comprehensive operating agreements. These documents outline financial obligations, maintenance responsibilities and exit strategies.In 2025, as housing costs rise, TIC is increasingly seen as an attractive path to homeownership since it enables individuals to pool resources. Each owner can independently sell, mortgage or will their portion of the property, offering significant autonomy.How a tenancy in common agreement works

A tenancy in common agreement is a form of fractional ownership where two or more people divide the costs associated with buying and owning a piece of real estate. A TIC agreement can involve an unlimited number of co-owners and apply to both residential and commercial properties.

| 10 essential elements of a tenancy in common agreement |

|---|

| 1. Property details and description |

| 2. Percentage shares of each co-owner |

| 3. Financial responsibilities of each co-owner |

| 4. Guidelines for sharing profits or rental income |

| 5. Protocol for property management decision-making |

| 6. Procedures for resolving disputes among co-owners |

| 7. Guidelines for the sale or transfer of shares |

| 8. Backup plans for unforeseen circumstances |

| 9. Potential exit strategies |

| 10. Legal clauses relevant to the TIC jurisdiction |

- The deed must transfer to the group of co-owners: All it takes to form a tenancy in common is for one owner to transfer a deed to a co-owner group.

- The group must agree to a tenancy in common agreement: A TIC agreement outlines how each owner will benefit financially from the property and defines how time will be allocated between each co-owner.

| Expert tip: Individual states regulate real estate differently, so it is always best practice to review state rules and regulations when making real estate decisions. |

How to finance a tenancy in common

Although a tenancy in common is a form of fractional ownership, you still have access to traditional funding opportunities like loans. When it comes to financing a tenancy in common, you have two options:- Group loan: If you get a group loan, you're all responsible for the whole mortgage. If one co-owner defaults, the others must cover their share.

- Individual loans: Each co-owner can get their own loan, like a standard single-owner mortgage. You are not responsible for the other co-owners' mortgages.

Tenancy in common property taxes

In general, a tax jurisdiction may require property taxes to be paid as a unit. This may be because shared ownership within a TIC doesn’t physically divide a parcel of land. Although you may have to pay property taxes as a unit, each co-owner may be eligible to deduct their property tax payments. If your TIC receives a single tax bill, your tenancy in common agreement will determine how the property taxes are paid. A common tax strategy within TIC agreements is for each member to pay property taxes equal to the percentage of their ownership. The TIC agreement should also present how the funds are collected and taxes paid.Pros and cons of tenancy in common real estate

As an arrangement that enables multiple individuals to share ownership of a single property, TIC brings a set of distinct advantages and challenges that prospective homeowners must consider.Understanding these key factors is essential in making informed decisions and forging successful co-ownership partnerships. Let’s dive into the pros and cons of tenancy in common.| Pros | Cons |

| Simplifies property purchases | Lacks automatic survivorship rights |

| Easily change the number of tenants | All tenants are liable for debt and taxes |

| Allows for varying degrees of ownership | One tenant can force a property sale |

Tenancy in common advantages

Here are the core advantages of opting for a tenancy in common agreement:- Simplifies property purchases: Tenancy in common simplifies property buying by enabling multiple parties to collectively invest in a property.

- Easily change the number of tenants: TIC allows for the easy addition or removal of co-owners without significantly altering the ownership structure.

- Allows for varying degrees of ownership: Tenancy in common permits unequal ownership shares, enabling individuals to invest different amounts based on their financial abilities or ownership preferences.

Tenancy in common disadvantages

Although a TIC agreement can be an easily customizable and flexible ownership arrangement, it also has its drawbacks, such as:- Lacks automatic survivorship rights: In a tenancy in common, there's no automatic transfer of a co-owner's share to others upon their death, creating potential disputes over the deceased co-owner's share.

- All tenants are liable for debt and taxes: Each co-owner shares equal responsibility for property-related debts and taxes, potentially causing financial complications if one co-owner fails to meet their obligations.

- One tenant can force a property sale: A single co-owner in tenancy in common can initiate the sale of the entire property, potentially leading to disputes among co-owners regarding how to sell and distribute shares.

Tenancy in common example

Now that you understand the basics of how tenancy in common operates, let’s see how this ownership model plays out in a real-world example. In this scenario, three families enter into a tenancy in common agreement:| The Jones, Richmond and Stevens families share a mountain cabin. The Jones family holds half of the property value, while the Richmond and Stevens families each hold one-quarter ownership. They visit the cabin throughout the years with equal usage rights, and each family plans to pass down their ownership rights to their kids. From there, the heirs can decide to sell the property and distribute the proceeds in line with their ownership interests or keep their shares. |

Tenancy in common vs. joint tenancy

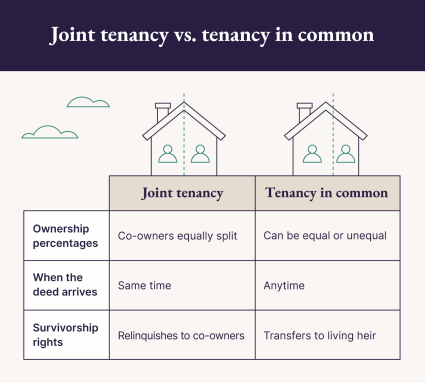

The major difference between joint tenancy and tenancy in common is how the percentage of ownership is allocated between co-owners.

- Joint tenancy: Tenants hold equal percentage ownership, get their deeds at the same time and relinquish their rights to co-owners upon their death (survivorship rights).

- Tenancy in common: Tenants may have unequal interests in their property. They can come into ownership at varying times in the life of the property and do not have survivorship rights. Instead, their shares are willed to a living heir.

Comparing the different types of tenancy

To understand property ownership, you have to differentiate between the various types of tenancies — and there's more than just the two we've mentioned already.| Types of tenancy |

| Tenancy in severalty: Single ownership |

| Tenancy in common: Multiple owners, varying shares, independent transfer |

| Joint tenancy: Equal shares, right of survivorship |

| Tenancy by entirety: Joint tenancy for married couples, with added protections |

- Tenancy in severalty: This is the simplest form of ownership, although you might not know it by that name. In this type of ownership, a single individual or entity holds complete title to the property. A sole proprietor owning a business property would be an example of tenancy in severalty.

- Tenancy in common: As we've covered, this type of property ownership allows multiple owners to hold varying percentages of a property, with each owner able to sell or bequeath their share independently. For example, two friends might buy a vacation home, with one owning 60% and the other 40%, reflecting their initial investment.

- Joint tenancy: This form of ownership requires equal shares among owners — but with a "right of survivorship." This means that if the owner who owned 60% of the property dies, their share automatically passes to the remaining owner, who formerly only owned 40% of the property. The remaining owner now owns 100% of the property.

- Tenancy by entirety: This is a specialized form of joint tenancy available only to married couples. It includes the right of survivorship but offers additional legal protections, such as shielding the property from individual creditors.

How to dissolve a tenancy in common agreement

Dissolving a tenancy in common is relatively straightforward and easy to accomplish, assuming all co-owners wish to end the agreement. To dissolve a tenancy in common agreement, each member must sell their shares of the property. This can only happen if all the owners agree to sell their ownership rights and split proceeds according to ownership interest percentages. Additionally, seeking legal advice, drafting a formal dissolution agreement and adhering to the legal procedures required in your jurisdiction are crucial steps in the dissolution process.| Expert tip: If there’s a dispute over whether to sell, one owner can file a partition action so that the investment can be liquidated to the other co-owners. |

Tenancy in common FAQ

01: What does tenancy in common mean?

Tenancy in common is a co-ownership structure that allows multiple individuals to hold separate, potentially unequal, interests in a property. It offers a lot of flexibility for multiple owners to own different amounts of a property.

02: What is the difference between joint tenancy vs. tenancy in common?

The most significant difference between joint tenancy and tenancy in common is who gets access to your share of the property in the event of your death. Joint tenancy is like a shared bank account — if one person dies, the others automatically get their share. Tenancy in common is different; you can own different amounts, and your share goes to your heirs, not the other owners.

03: What are the responsibilities of tenants in common?

Tenants in common are responsible for sharing property expenses, seeking mutual agreement for property changes and ensuring fair property access between tenants.

04: Do you have to be related to form a tenancy in common?

No, owners do not have to be related to form a tenancy in common. However, relatives can also take advantage of a TIC if they choose to do so.

05: How does marriage affect tenancy in common?

Marriage can potentially convert a tenancy in common to a tenancy by the entirety or joint tenancy with the right of survivorship, depending on the jurisdiction of the TIC agreement.

06: What is tenancy by the entirety?

Tenancy by the entirety is a form of property ownership where both parties jointly own the entire property as one entity with rights of survivorship.

07: How do you transfer your shares in a tenancy in common?

Shares can be bought out by fellow tenants, sold to a new owner or willed to an heir.

08: What happens if a tenant wants to sell?

Owners can sell or will their shares independently. When a property can’t be divided equally, it leads to a forced sale through a court order called a partition action. Co-tenants can always opt to buy out any owner who wants to sell.

09: Can tenancy in common be dissolved?

Yes, selling a property dissolves the tenancy in common. However, all owners must agree to this action.

010: What happens when a tenant dies?

In the event that a tenant dies, their shares would pass to a living heir instead of the remaining co-owners.