Why should U.S. buyers purchase real estate in the U.K. now?

The U.S. dollar and British pound exchange rate is hovering below 1:1, the most favorable it has been in nearly 15 years. The British pound has fallen 47.9% from its peak in 2007, a roughly 19.6% decline from 12 months before.¹This favorable exchange rate means U.S. buyers can take advantage of significant savings in the British real estate market. For example, a £500,000 home in the U.K. would cost $541,250 today compared to a cost of $673,600 12 months ago — a savings of nearly 20% and $132,350.² This means now is the most cost-effective time for U.S. buyers to purchase a home or second home in London.

Why is the crash in the U.K. happening?

British Prime Minister Liz Truss’s proposal to cut taxes to stimulate growth sparked a lack of confidence in the U.K. government’s debt. This led to an immediate fall in the power of the British pound.If a recession is looming, would it be smarter to purchase real estate in London or invest in the stock market?

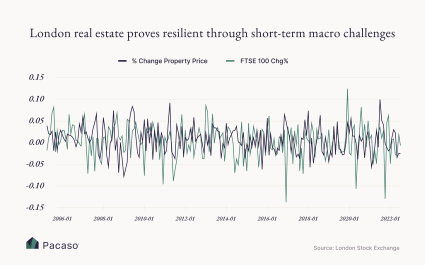

While we can’t give investment advice, historical data shows that, similar to U.S. real estate, British real estate has been more stable than the typical London Stock Exchange indexes during periods of economic recession since 2005.³ Like gold or treasury securities, real estate is used by many as a hedge against inflation and volatility in the market.

Does real estate in London hold its value?

Since 2005, the appreciation of real estate in London has significantly outpaced the London Stock Exchange, similar to the value of real estate in the U.S. Despite the record low exchange rates, real estate in London has been proven to hold its value. For example, for those looking to purchase a home in the city, real estate in the posh neighborhood of Chelsea district of London has appreciated by 165.96% compared to just 43.32% for the Financial Times Stock Exchange 100 Index.⁴

Should buyers purchase a second home in London?

From its rich history and culture to potential second home tax savings, there are many reasons to own a second home in the U.K. And with a fully managed co-ownership model like Pacaso, you can responsibly buy, own and enjoy a second home in a world-class destination like London for a fraction of the cost.1. Xe.com. 2022. XE Currency Converter - Live Rates. [online] Available at: <http://www.xe.com/currencyconverter/> [Accessed 1 Oct 2022]2. Landregistry.data.gov.uk. 2022. UK House Price Index. [online] Available at: <https://landregistry.data.gov.uk/app/ukhpi> [Accessed 1 October 2022].3. Londonstockexchange.com. 2022.Indices - London Stock Exchange. [online] Available at: <https://www.londonstockexchange.com/market-data/all> [Accessed 1 October 2022].4. Londonstockexchange.com. 2022.Indices - London Stock Exchange. [online] Available at: <https://www.londonstockexchange.com/market-data/all> [Accessed 1 October 2022].