How to use a 401(k) to buy a house

There are two main ways to use a 401(k) to fund a home purchase: taking out a 401(k) loan or making a 401(k) withdrawal. Each has pros and cons depending on age, employment and long-term financial strategy. Let’s break it down.Obtain a 401(k) loan

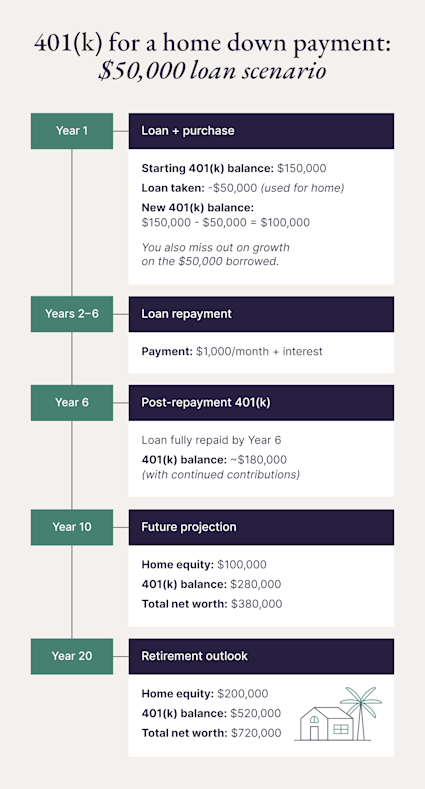

A 401(k) loan for a home purchase allows you to borrow money from your own retirement account and repay it with interest, usually through automatic paycheck deductions. To secure a 401(k) loan for a home purchase through your employer, follow these steps:- Check if your plan allows loans. Not all do. Ask your HR department or plan administrator.

- Complete the loan application. Be clear about how much you need and how you’ll use it.

- Set your loan amount. You can typically borrow up to $50,000 or 50% of your vested balance, whichever is less.

- Review the terms. Look closely at the repayment schedule, fees, and interest rate.

- Submit and wait for approval. Processing time varies.

| Pros of a 401(k) loan | Cons of a 401(k) loan |

|---|---|

| No credit check required | You’re borrowing against your retirement future |

| No early withdrawal penalties | Leaving your job may accelerate repayment |

| No income tax if repaid on time | Missed repayments can trigger taxes and penalties |

| Quick access to funds |

Make a 401(k) withdrawal

A 401(k) withdrawal for a home purchase is possible, but be cautious. Unlike a loan, you’re permanently removing funds from your account, and if you’re under 59, you’ll likely face a 10% early withdrawal penalty, plus income tax.Here is how to make a 401(k) withdrawal:- Review withdrawal rules. Not every plan allows early withdrawals, and some require specific hardship conditions.

- Confirm your withdrawal amount. Talk to your administrator to determine what you can access.

- Receive funds and plan for taxes. The amount you withdraw will be subject to both federal and possibly state income tax.

| Pros of making a 401(k) withdrawal | Cons of making a 401(k) withdrawal |

|---|---|

| No repayment required | 10% early withdrawal penalty (unless exempt) |

| Quick access to funds | Lost growth potential for retirement savings |

| No loan repayment structure to rebuild funds | |

| It may affect your overall buying power after reducing your assets |

| Tip: It’s wise to get a financial advisor’s expert input before going forward on a loan against your 401(k) or a withdrawal before you’re 60 years old. |

Penalty-free 401(k) withdrawal exemptions

If you’re under 59.5 years old, early withdrawals typically trigger a 10% penalty. However, certain situations qualify for penalty-free withdrawals. Here’s how to use your 401(k) to buy a house:- First-time homebuyer withdrawal: You can withdraw up to $10,000 penalty-free.

- Hardship withdrawal: Applies to cases like unreimbursed medical bills or funeral expenses. You’ll still owe income tax.

- 401(k) loan: Technically not a withdrawal. It’s a repayable loan, which avoids penalties if managed correctly.

Key considerations before tapping into your 401(k) for home ownership

Before you unlock your retirement savings, weigh their impact on your retirement. It’s important to see if an investment in a second home merits a 401(k) loan or withdrawal. Consider these key factors:- Penalties and taxes: Early withdrawals may incur a 10% fee and income tax, unless you qualify for an exemption.

- Impact on retirement: The more you withdraw now, the less you’ll have later. Compound growth takes a hit.

- Job stability: If you take a loan and change jobs, you may have to repay it fast or face penalties.

- Plan limitations: Some employers don’t allow loans or hardship withdrawals. Always check your plan details.

Alternatives to using your 401(k) for buying a house

Dipping into your 401(k) isn’t the only option to get cash to buy a vacation home. Consider these other ways:- Traditional IRA: May allow up to $10,000 for a first-time home purchase. It’s subject to income tax.

- Roth IRA: If eligible, you can withdraw up to $10,000 from your Roth IRA tax-free and penalty-free for a qualified first-time home purchase.

- Self-directed IRA: This type of IRA lets you invest directly in real estate, but it has added rules and risks. If you can, discuss it with a financial advisor first.

- FHA Loans: Great for primary residences, with lower down payment requirements.

- Save over time: It's old-fashioned but effective. Set a monthly budget and stay consistent toward your down payment goal.

Get your dream second home with Pacaso

Still wondering if you can use a 401(k) to buy a house? The answer is yes, but whether it’s the best move depends on your goals. While some buyers tap into retirement accounts, others explore co-ownership models or alternative financing strategies.If you’re looking for a smarter way to own a second home, Pacaso offers a modern twist on luxury real estate. We make it easier to co-own dream properties, even with friends, in top destinations—from Napa to Aspen. You get all the joy of second home ownership, minus the full-time price tag or responsibility.Explore our portfolio and find your second home today.Using your 401K to buy a house FAQ

01: Can I use my 401(k) without penalty?

Yes, you can make a 401(k) withdrawal for a home purchase if you meet the hardship or loan exemption requirements of purchasing a primary residence.

02: How much of my 401(k) can I withdraw to buy a house?

Depending on your company's 401(k) plan, you can withdraw up to $10,000 or 50% of your retirement savings account.

03: Can I use my 401(k) for a down payment?

Yes, you can use a 401(k) loan for a down payment. However, you may be subject to penalties and may need to find additional funding sources.

04: Can I withdraw money from my 401(k) to buy a vacation home?

The IRS allows penalty-free withdrawals up to $10,000 for a first-time home purchase, so you may not be able to use your 401(k) to buy a vacation home without paying a penalty.

05: Can I use my 401(k) to buy a house at age 65?

Yes, you can use your 401(k) to buy a house at 65. Once you’re over 59.5, you can withdraw from your 401(k) without the 10% penalty, though you’ll still owe income tax.

06: How does taking out a loan versus an early withdrawal affect my retirement savings?

A loan allows for repayment and preserves some long-term growth. A withdrawal permanently reduces your retirement balance.

07: Are there specific rules or exceptions for first-time homebuyers using their 401(k)?

Yes. First-time buyers may withdraw up to $10,000 penalty-free, though income taxes still apply.