| Can I use my IRA to buy a house without penalty?Yes, you can withdraw up to $10,000 without penalty if you qualify for early withdrawal exemptions. |

Penalty-free withdrawal qualifications

- First-time home buyers: The "first-time homebuyer" status refers to not having owned a home in the past two years.

- Death of the IRA owner: You may make penalty-free withdrawals to purchase a home if you inherit the IRA from the original owner.

- 59½ years old or older: This is the age retirement account owners can begin withdrawing without a penalty.

Withdrawal differences between traditional and Roth IRAs

Can you use a Roth IRA to buy a house? Yes, both traditional and Roth IRAs offer provisions for penalty-free early withdrawals, but there are differences in how these withdrawals are treated in terms of taxes and eligibility. Here's a breakdown of the key differences between Roth IRA and traditional IRA withdrawal rules:- With traditional IRAs, first-time homebuyers can withdraw up to $10,000 without the 10% penalty, though taxes will be owed on the withdrawn amount.

- With Roth IRAs, the same penalty-free rules apply. However, this IRA may offer more flexibility since contributions (money you've already paid taxes on) can be withdrawn anytime without taxes or penalties.

How to use an IRA to buy a house

1. Check the IRS qualifications

If you plan on withdrawing funds from your traditional IRA, double-check the IRS withdrawal exemptions to ensure that you qualify for penalty-free withdrawals. If you skip this step and don't meet the exemption requirements, you could owe a 10% withdrawal penalty fee and income taxes.2. Choose your retirement account

After you’re sure you qualify for penalty-free withdrawals, it’s time to choose which account to take funds from. With various retirement account options, it’s important to note the difference between your early withdrawal options:- Traditional IRA: This IRA is potentially a good option for first-time home buyers or those who haven’t owned a home in the last two years.

- Roth IRA: A Roth IRA is another option first-time home buyers should consider. Remember that withdrawing from this account could result in a loss of interest and potential gains from compounding.

- Self-directed IRA: Unlike traditional and Roth IRAs, a self-directed IRA can be a dynamic way to purchase real estate. If you want to buy a second home to generate rental income, for example, then you can purchase a property with a self-directed IRA — as long as the home isn’t for personal use.

- 401(k): You can withdraw from your 401(k) to buy a home by applying for a loan of up to $50,000 or the hardship withdrawal exemption. Consider using this account if you do not qualify for penalty-free early IRA withdrawals.

3. Confirm your withdrawal amount

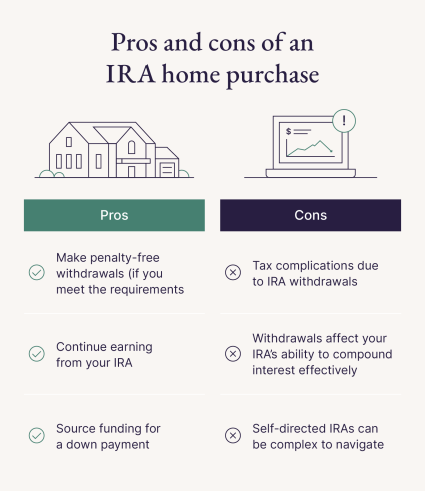

Retirement account holders can withdraw up to $10,000 from their IRA. Although you can withdraw the maximum amount, it’s important to keep your savings goals and contribution limits in mind when making this decision. If that amount is not enough to cover your entire down payment, you may also need other funding sources.Even though the first-time home buyer exemption gives homebuyers an advantageous solution to their down payment problems, withdrawing from your IRA also has drawbacks that you should carefully consider. Let’s take a look at the pros and cons of involving your IRA in a home purchase.Pros and cons of an IRA home purchase

- Penalty-free: You can potentially make a first-time home buyer IRA withdrawal without penalty.

- Long-term savings: Even after withdrawing funds for a home, your IRA can continue growing and compounding, providing potential future retirement benefits.

- First-time homebuyer status: IRAs can assist those who haven't owned a home for at least the past two years to enter the housing market.

- Tax implications: Traditional IRA withdrawals are taxed as income, affecting your annual tax liability.

- Lack of compounding: Withdrawing impacts the IRA's ability to maximize compound earnings.

- Nest egg risk: Using retirement funds for a home purchase might lead to insufficient savings during retirement.

- Complexity: Self-directed IRAs involve additional complexities, risks and potential fees due to unconventional investments like cryptocurrency.

IRA withdrawal for home purchase FAQ

01: Can you use retirement funds to buy a house?

Yes, you can use retirement funds to buy a house. If you would like to avoid paying an early withdrawal penalty, you must qualify for exemptions.

02: How do I report an IRA withdrawal on my taxes?

To report an IRA withdrawal, submit Form 1099-R when filing your taxes.

03: Can I use my IRA as a down payment on a house?

Yes, you can use your IRA as a down payment on a house. However, you may be subject to a $10,000 withdrawal limit, so keep that in mind while securing funding for your down payment.

04: At what age is IRA withdrawal penalty-free?

In most cases, you must be 59½ years old or older to qualify for free withdrawals from your IRA.