| Key takeaways |

|---|

| You’ve probably heard of timeshares, but you may be wondering how timeshares work. This guide has everything you need to know about timeshares, from the different types of timeshares, to associated costs, so you can make an informed decision about what’s best for your vacation plans. |

Menu

- What is a timeshare?

- How do timeshares work?

- What are the different types of timeshares?

- How are timeshares split?

- How much does a timeshare cost?

- What are the pros and cons of timeshares?

- What does exiting a timeshare look like?

- What are some timeshare alternatives?

- What’s the difference between fractional ownership and timeshares?

- What’s the difference between vacation clubs, timeshares, and second homes?

- How does Pacaso differ from timeshares?

| What is a timeshare? |

|---|

| A timeshare is when multiple individuals collectively invest in and share the use of a vacation property, often in hotels or resorts. Each timeshare owner is allocated a specific number of days or weeks to use the property each year. |

How do timeshares work?

A timeshare is a shared vacation property ownership model, most often connected to hotels or resorts. Instead of one buyer owning the property outright, the ownership is divided among multiple people (typically up to 52) so each person has the right to use it for a set number of days or weeks per year.Think of it as purchasing time rather than the property itself. Owners don’t hold full real estate ownership but instead secure the right to stay in the same accommodation at recurring intervals. For example, if a unit is divided among 52 owners, each person usually gets one week of use annually.This arrangement makes vacation homes more affordable while guaranteeing consistent access to popular destinations. However, it’s important to note that timeshares generally tie you to a single property, unlike vacation clubs that offer access to multiple locations. While this model is common for vacation spots, it's seldom applied to individual residential homes.Here’s a closer look at the general steps that show how timeshares work:- Choose a timeshare type: You can select between several models, such as deeded ownership (which grants a share of the property deed), leasehold (which expires after a certain number of years) or points-based systems that let you trade time at different resorts. Each option determines how flexible your stay can be and how easily you can exchange destinations.

- Purchase the timeshare: After selecting a type, buyers sign a contract that defines the property, usage schedule and financial terms. Most purchases are for a single resort or brand network.

- Pay ongoing fees: In addition to the upfront cost, you also pay annual maintenance fees that cover property upkeep, utilities and management costs. These fees can increase over time, even if you don’t use your week.

- Reserve your time: Depending on your timeshare model, you may need to book your stay well in advance to secure your preferred dates. Popular seasons often fill quickly, which can limit flexibility.

- Enjoy your vacation: Once reserved, you can enjoy your allotted time at the property each year — though returning to the same place on the same schedule isn’t ideal for everyone who craves variety in their travel plans.

Real-world timeshare example

| Timeshare property | Resort in Los Cabos, Mexico |

| Initial cost | $25,000 |

| Annual maintenance fees | $1,300 |

| Allocated time each year per contract | 2 weeks |

| Total years vacationing at this timeshare | 10 years |

| Total costs | $38,000 ($25,000 initial cost + $1,300 annual fee x 10 years) |

| Cost per night | $271 ($38,000/140 nights or 14 nights/years) |

What are the different types of timeshares?

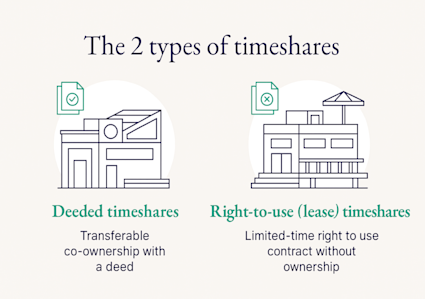

Deeded timeshares

Transferable co-ownership with a deedDeeded timeshares divide ownership of a property into smaller shares that reflect how long you can stay. For example, a property split into two-week intervals would have 26 owners. The most common model is a 52-part split, one for each week of the year. With a deeded timeshare, you hold real ownership that can be sold, willed to family, or transferred. Most timeshares in the U.S. are deeded.Right-to-use (lease) timeshares

Limited-time right to use contract without ownershipRight-to-use (RTU) or leasehold timeshares operate more like a long-term rental. Instead of owning a portion of the property, you lease the right to stay for a set number of years—commonly 20 to 99. Once the contract expires, your usage rights end. Like deeded models, you’ll still share the property with other owners, often up to 52 families.How are timeshares split?

With an understanding of the two main types of timeshare contracts, let’s explore the three primary ways vacation time is divided among owners.

- Understand the product: Know the exact type of timeshare you're being offered and learn about industry rules and regulations.

- Get clear terms: Ask for a concise, easy-to-understand outline of the purchase terms.

- Assess the property: Look for signs of good property management and well-maintained facilities. Review the resort's annual budget.

Fixed-week timeshare

Fixed weeks mean you’re locked into the same week every year (say, the third week in April). While this offers the predictability of always having your vacation secured at a specific time, it also means your travel dates are rigid. Changing your fixed week usually comes with a hefty price tag in the form of an upgrade fee, if it's even possible, making it less flexible for those whose schedules vary from year to year.Floating-week timeshare

Floating weeks let you choose your week seasonally. This offers more flexibility than a fixed-week model, since you're not tied to the exact same dates every year. However, that flexibility comes with a trade-off: floating week systems are very competitive among timeshare owners, and the best slots during high season get snatched up quickly. You'll often need to book far in advance to secure your preferred dates. If keeping your average vacation cost low is the priority, consider choosing a slot during the low season. It will be easier to book, but you might also find fewer crowds and a more relaxed atmosphere.Points-system timeshare

Some timeshare properties operate with a points system where you “pay” for your stay with points, giving you greater flexibility in how you travel. This means you're not restricted to a single property or a specific time slot each year. Choosing an off-season, weekday stay or downgrading to a smaller room may cost fewer points overall, allowing you to stretch your points for more frequent, shorter getaways or save them up for something bigger. By contrast, you can also use points to upgrade components of your vacation, such as getting a bigger room or a better view — or even enjoy another second home destination via a timeshare exchange program.| Timeshare model | Fixed weeks | Floating weeks | Points system |

|---|---|---|---|

| How it works | Same week every year | Choose your week seasonally | Pay for your stay with points |

| Pros | Predictability | More flexibility than fixed weeks | Most flexible option with no restriction to a single property or time slot each year |

| Cons | Less flexibility for travel dates | Highly competitive for popular dates | Can be complex to understand and may require more points for in-demand dates |

How much does a timeshare cost?

A timeshare's cost involves two main components: an initial purchase price and ongoing annual fees.The initial cost to buy a timeshare is more than $20,000, though this can vary significantly based on the property, location and the specific contract terms.In addition to the upfront payment, you'll be responsible for annual maintenance fees and any other charges outlined in your contract for the lifetime of your timeshare. These fees cover essential expenses such as maintenance, utilities and property taxes. They average around $1,300 per year and are mandatory, regardless of whether you use your allocated days at the property each year.Be sure to check the terms of your timeshare contract before signing. This document should outline all of the one-time and ongoing costs, including:- Initial purchase price

- Closing costs

- Maintenance fees

- Transfer fees

- Property taxes

Financing a timeshare

Banks typically do not offer loans for timeshares, leaving buyers with limited financing options outside of the timeshare company itself. With little competition, some companies rely on high-pressure sales tactics and may charge interest rates between 14% and 20%—significantly higher than most second-home loans on the open market.These factors can greatly increase the overall cost of a timeshare, making it crucial for buyers to carefully review the full financial commitment before signing any agreements. Using a second-home mortgage calculator can help estimate and compare potential costs.What are the pros and cons of a timeshare?

To really know if timeshares are worth it, you need to weigh all the pros and cons. Timeshares can be appealing for travelers drawn to popular destinations with plenty to do. Some ownership models also offer flexibility, such as trading locations with other owners, using a portion of nights to explore new places, or sharing usage with friends and family.However, there are downsides to consider. Annual fees and special assessments can be costly, and selling a timeshare on the secondary market can be challenging if it’s no longer the right fit. The industry has also gained a reputation for high-pressure sales tactics. Additionally, timeshare ownership typically does not provide the financial benefits of traditional real estate, such as equity growth, tax deductions or rental income.| Pros | Cons |

|---|---|

| Access properties in great destinations | Expensive annual fees |

| Only pay for the time you use | Pushy sales tactics |

| Point systems with unique perks | Difficult to sell |

What does exiting a timeshare look like?

If a buyer eventually decides to sell their timeshare, recouping the initial investment and yearly maintenance fees can be difficult. While new timeshare sales continue to grow, the resale market is flooded, with 201,600 timeshare units listed across 1,541 resorts in the U.S., with more added each year. Supply far exceeds demand, making it challenging for individual owners to sell their timeshares at a desirable price.While exiting a timeshare is notoriously challenging, there are six key strategies for how to get out of a timeshare with little to no financial damage:- Use the rescission period – Most states give buyers a short window after purchase to cancel without penalty.

- Request a deed-back – Some resorts offer buyback programs that let you legally return your timeshare.

- Sell on the resale market – A possible option if your timeshare is fully paid off; encumbered contracts can’t be sold.

- Work with a reputable exit company – A last-resort option that can help navigate the process.

- Donate the property – Fully paid-off timeshares may be donated to certain charities, sometimes with tax benefits.

- Hire a contract law attorney – Costly, but sometimes necessary for complex or disputed contracts.

What are some timeshare alternatives?

With the high costs and limitations associated with timeshares, it’s recommended you first explore timeshare alternatives to make sure you choose the best vacation option for you. From second home co-ownership and vacation home ownership to vacation rentals, travel clubs, and resorts, each timeshare alternative comes with its own set of features. Options differ in flexibility, ownership structure, fees, and overall cost, allowing vacationers to choose what best fits their needs and lifestyle.What’s the difference between fractional ownership and timeshares?

When comparing fractional ownership vs. timeshares, specifically deeded timeshares, the distinction comes down to a few key factors. Both involve partial ownership of a property, but in a deeded timeshare, each owner holds a legal deed tied to a specific time period—typically one or two weeks per year—rather than a percentage of the property’s total value. Fractional ownership, on the other hand, provides true co-ownership, allowing owners to hold equity in the entire property itself.The benefits of fractional ownership become clear across factors like the number of owners, scheduling flexibility, equity, management, maintenance, building type, cost, and resale value. Fractional ownership generally means fewer owners, more flexible scheduling, and a share that can appreciate over time. Owners also enjoy the comfort of luxury vacation homes rather than individual units within hotels or resorts.What’s the difference between vacation clubs, timeshares, and second homes?

The main differences between vacation clubs, timeshares, and second homes come down to convenience, flexibility, and cost. When comparing vacation club vs. timeshares, the distinction is clear: vacation clubs are membership-based programs that provide access to a portfolio of destinations, accommodations, and experiences, while timeshares involve specific properties shared by multiple owners, with each owner granted a set period of time each year to use the property.Owning a second home — usually a vacation property separate from your primary residence — offers you the freedom to visit multiple times per year, potential property appreciation, and the ability to avoid the challenges of reselling a timeshare.How does Pacaso differ from timeshares?

- Cost: One of the main reasons people choose a timeshare over another type of vacation — like buying a second home — is cost. The upfront price seems lower than buying a second home. However, when annual maintenance fees and limited access are factored in, many owners find the total cost is higher than anticipated.

- Equity: Although owning multiple homes can be costly, true real estate ownership appreciates with the market, allowing owners to build equity. For those who find the cost of second home ownership out of reach, co-owning a second home can be a more accessible alternative.

- Fully managed: Pacaso co-ownership gives you the benefits of second home ownership without the hassles. Unlike timeshares, every Pacaso home is professionally managed so upkeep and maintenance are always taken care of.

- LLC structure: Each Pacaso is owned through a property-specific LLC controlled by two to eight co-owners. All costs flow transparently through the LLC, helping you avoid hidden fees.

- Frequent usage: You’re guaranteed far more than a week’s stay — on average, owners of a 1/8 share in a Pacaso stay at their homes six or seven times a year for about a week at a time.

| Timeshare | Pacaso | |

| Ownership type | Right to use time, not the property itself | True property ownership through an LLC |

| Equity | No equity or real estate appreciation | Builds equity as the home’s value increases |

| Use flexibility | Fixed or limited time each year | Flexible scheduling throughout the year |

| Quality of property | Hotel or resort units | Luxury single-family second homes |

| Privacy | Shared resort environment | Private home experience |

| Costs | Upfront cost plus rising annual fees | One-time share purchase with transparent operating costs |

| Resale | Difficult resale with major value loss | Streamlined resale process at fair market value |

| Management | Resort-managed; limited control | Fully managed and professionally maintained by Pacaso |

Benefits Pacaso offers

- True real estate property ownership that moves in value with the market, so any equity realized is yours.

- Ownership of a luxurious single-family second home, not the right to use a condo or hotel room. You and your co-owners own 100% of the home.

- A professionally designed, beautifully furnished and well-appointed home, complete with everything you need for a comfortable and relaxing stay.

- Between 2 to 8 vetted owners who have exclusive access to the home that is never rented. A timeshare unit may be sold to 52 owners or rented out when vacant.

- No hidden fees. Operating expenses are passed along equitably and at cost to owners.

- On average, owners stay at their homes 6-7 times per share per year, depending on their personal travel preferences. They can easily schedule their stays and use their home on an ongoing basis.

Timeshares FAQ

01: What is the difference between deeded and right-to-use timeshares?

Owners of a timeshare without a deed cannot pass down the property to loved ones. This means that upon the owner's death, the timeshare interest typically reverts to the developer or management company, rather than becoming part of their estate.

02: Do you own anything when you have a timeshare?

Whether you "own" anything with a timeshare depends on the type of timeshare. With a deeded timeshare, you do own a fractional interest in the physical property itself, similar to real estate. However, with a "right-to-use" or leased timeshare, you only own the right to use the property for a specified period, and the developer retains the actual deed.

03: Do you ever pay off a timeshare?

While you can pay off the initial purchase price of a timeshare, you will almost always continue to pay annual maintenance fees and potentially other assessments for as long as you own it. These ongoing fees mean a timeshare is rarely "paid off" in the same way a traditional mortgage or car loan is.

04: What is the difference between fixed weeks, floating weeks and points in a timeshare contract?

A fixed-week system lets you purchase a specific week to use your timeshare property every year. A floating-week system gives you the flexibility to vacation any week within a certain season, but you have to book early. With a points system, you purchase points that you can use to stay in any one of multiple resorts within the timeshare company.

05: Why is it so hard to get out of a timeshare?

Exiting a timeshare can be challenging because the resale market is oversaturated, with many owners trying to sell at the same time. Resorts may also enforce strict contract terms and impose fees or restrictions on resales, making it difficult to recoup the initial investment and annual maintenance costs.

06: Do you own a timeshare forever?

It depends on the type of timeshare. A deeded timeshare is considered real property, so you own it indefinitely until you sell, transfer, or will it to someone else. A right-to-use timeshare only lasts for a set number of years outlined in your contract.

07: What happens when my timeshare is paid off?

Even after paying off the initial purchase price, you’ll still owe annual maintenance fees and any special assessments charged by the resort. These costs continue for as long as you own the timeshare.

08: How do Pacaso owners schedule time in their Pacaso?

Pacaso’s SmartStay system lets you view availability and secure a stay in your Pacaso in real time. The app’s technology is designed to ensure that owners are treated equitably based on their ownership share in the property. Learn more about Pacaso’s stress-free scheduling.